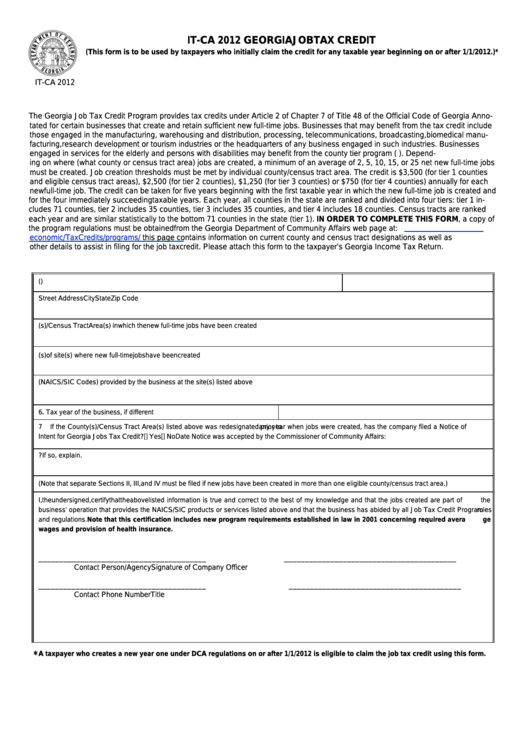

IT-CA 2012 GEORGIA JOB TAX CREDIT

(This form is to be used by taxpayers who initially claim the credit for any taxable year beginning on or after 1/1/2012.)*

Print

Clear

IT-CA 2012

Part I.

CERTIFICATION AND INSTRUCTIONS

The Georgia Job Tax Credit Program provides tax credits under Article 2 of Chapter 7 of Title 48 of the Official Code of Georgia Anno-

tated for certain businesses that create and retain sufficient new full-time jobs. Businesses that may benefit from the tax credit include

those engaged in the manufacturing, warehousing and distribution, processing, telecommunications, broadcasting, biomedical manu-

facturing, research development or tourism industries or the headquarters of any business engaged in such industries. Businesses

engaged in services for the elderly and persons with disabilities may benefit from the county tier program (O.C.G.A 48-7-40). Depend-

ing on where (what county or census tract area) jobs are created, a minimum of an average of 2, 5, 10, 15, or 25 net new full-time jobs

must be created. Job creation thresholds must be met by individual county/census tract area. The credit is $3,500 (for tier 1 counties

and eligible census tract areas), $2,500 (for tier 2 counties), $1,250 (for tier 3 counties) or $750 (for tier 4 counties) annually for each

new full-time job. The credit can be taken for five years beginning with the first taxable year in which the new full-time job is created and

for the four immediately succeeding taxable years. Each year, all counties in the state are ranked and divided into four tiers: tier 1 in-

cludes 71 counties, tier 2 includes 35 counties, tier 3 includes 35 counties, and tier 4 includes 18 counties. Census tracts are ranked

each year and are similar statistically to the bottom 71 counties in the state (tier 1). IN ORDER TO COMPLETE THIS FORM, a copy of

the program regulations must be obtained from the Georgia Department of Community Affairs web page at:

economic/TaxCredits/programs/taxcredit.asp

this page contains information on current county and census tract designations as well as

other details to assist in filing for the job tax credit. Please attach this form to the taxpayer’s Georgia Income Tax Return.

A.

CERTIFICATION FOR GEORGIA JOB TAX CREDIT PROGRAM

1. Name of business claiming credit

Phone Number (

)

Street Address

City

State

Zip Code

2. County(s)/Census Tract Area(s) in which the new full-time jobs have been created

3. Street address(s) of site(s) where new full-time jobs have been created

4. List the products or services (NAICS/SIC Codes) provided by the business at the site(s) listed above

5. Fiscal year of the business named above

.

6. Tax year of the business, if different

7

If the County(s)/Census Tract Area(s) listed above was redesignated

prior to

any year when jobs were created, has the company filed a Notice of

Intent for Georgia Jobs Tax Credit?

[

] Yes

[

] No

Date Notice was accepted by the Commissioner of Community Affairs:

8. Is the company listed above entitled to benefits of the Job Tax Credit Program by transfer from another company? If so, explain.

(Note that separate Sections II, III, and IV must be filed if new jobs have been created in more than one eligible county/census tract area.)

I, the undersigned, certify that the above listed information is true and correct to the best of my knowledge and that the jobs created are part of

the

business' operation that provides the NAICS/SIC products or services listed above and that the business has abided by all Job Tax Credit Program

rules

and regulations. Note that this certification includes new program requirements established in law in 2001 concerning required avera

ge

wages and provision of health insurance.

________________________________________

_________________________________________

Contact Person/Agency

Signature of Company Officer

________________________________________

_________________________________________

Contact Phone Number

Title

*

A taxpayer who creates a new year one under DCA regulations on or after 1/1/2012 is eligible to claim the job tax credit using this form.

1

1 2

2 3

3 4

4