IT-CA 20

Page 2

B. INSTRUCTIONS

Print

Clear

Part I

In order to complete Part 1 (CERTIFICATION AND INSTRUCTIONS) and the remainder of IT-CA 20

, the taxpayer must be familiar

with the law and regulations. Applicable law includes O.C.G.A. 48-7-40, O.C.G.A. 48-7-40.1, and O.C.G.A. 36-62-5-1.

Other law

may be applicable depending on taxpayer circumstances. Applicable regulations include regulations issued by the Georgia Depart-

ment of Community Affairs (Rules 110-9-1-.01, 110-9-1-.02, and 110-9-1-.03) and those issued by the Georgia Department of

Revenue (Rule 560-7-8-.36).

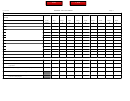

Part II

Provide the information requested on the number of full-time jobs at the end of each month based on the taxpayer’s fiscal year.

(See regulations issued by the Georgia Department of Community Affairs for further information.)

Part III-V

Year 1 is the tax year of new jobs increase and the Prior Year is the preceding tax year. (See Rule 110-9-1-.01 of the Job Tax

Credit Program Regulations for the definition of these and other terms.)

Line 1

Total employees is the total of full-time employees subject to Georgia income tax withholding at the end of each

applicable monthly reporting period.

Line 2

Number of months of operation in each tax year (usually 12).

Line 3

Monthly average of full-time employees (line 1 divided by line 2). Round to the nearest whole number.

Line 4

Previous year's monthly average from line 3.

Line 5

Average increase (decrease) in full-time employees (line 3 less line 4).

Line 6-10

Enter the appropriate average increase in the initial job creation year, with additional years reflecting the number

of new jobs which have been maintained.

See Rule 110-9-1-.03 of the

Job Tax Credit Program Regulations for

detailed instructions.

Line 11

Number of jobs eligible for credit equals the total of lines 6 - 10.

Line 12

Multiply line 11 by $3,500, $2,500, $1,250 or $750 depending on whether the business created jobs in a tier 1

county or eligible census tract area ($3,500 credit), tier 2 county ($2,500 credit), tier 3 county ($1,250 credit), or

tier 4 county ($750 credit) and add to this figure the amount of any unused credits from previous years. (The

unused credit amounts may not include credits designated to be used against withholding or credits that have

expired). Note that if jobs created under the county tier program (O.C.G.A. 48-7-40) have been created within a

multi-county joint development authority area, the

amount

of credit is increased by $500 per job. An existing

business enterprise as defined in O.C.G.A. 48-7-40(a)(4) will qualify for an additional $500 credit for each new full-

time job the first year in which the new full-time job is created, subject to the conditions and limitations in O.C.G.A

48-7-40 and DCA and DOR regulations. Also note that if jobs on Line 11 were created in different years, credit

amounts per job may vary depending on the credit amounts applicable in the years the jobs were created. See the

Job Tax Credit Regulations for further details.

Line 13

Enter the amount of tax liability for this tax year before any Job Tax Credit.

Line 14

Enter 50% of line 13 (for tier 3 or 4) or 100% of line 13 (for tier 1 or 2).

Line 15

Enter the lesser of line 14 or line 12. (Amount of Job Tax Credit for current year.)

he

Line 16

Enter t

amount of unused tax credits that may be carried forward: Line 15 minus line 12. Unused tax credit

may be carried forward for 10 years from the close of the tax year in which the qualified jobs were established.

Use the FIFO method to determine which tax credits expire at what time. See the Job Tax Credit Regulations for

further details.

The tax credit is calculated on the basis of the average number of new full-time jobs created by county or census

NOTE:

tract area by taxpayer. Before any credit can be received, a business must create at least an average of 2 (desig

nated Opportunity Zone

ilitary Zone areas

), 5 ( ess developed census tract area), 10 (tier 2

county), 15 (tier 3 county) or 25 (tier 4 county) new full-time jobs in an eligible county or census tract area. The

creation of 2, 5, 10, 15, or 25 jobs in two or more counties or census tract areas does not meet job threshold require-

ments.

1

1 2

2 3

3 4

4