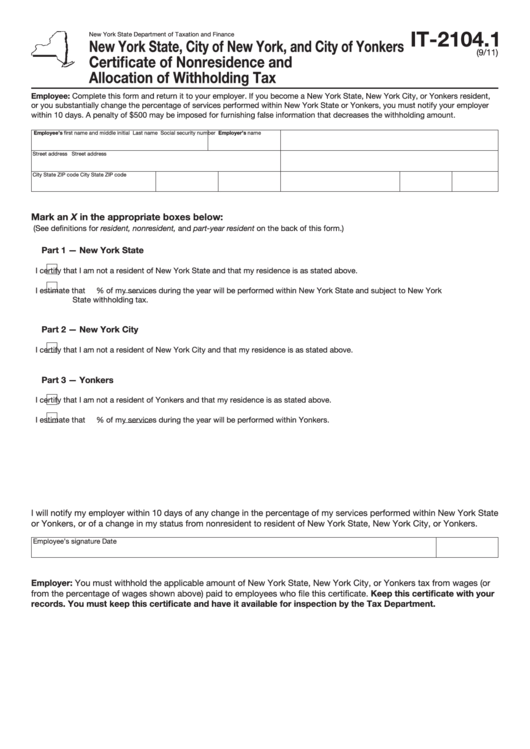

IT-2104.1

New York State Department of Taxation and Finance

New York State, City of New York, and City of Yonkers

(9/11)

Certificate of Nonresidence and

Allocation of Withholding Tax

Employee: Complete this form and return it to your employer. If you become a New York State, New York City, or Yonkers resident,

or you substantially change the percentage of services performed within New York State or Yonkers, you must notify your employer

within 10 days. A penalty of $500 may be imposed for furnishing false information that decreases the withholding amount.

Employee’s first name and middle initial

Employer’s name

Last name

Social security number

Street address

Street address

City

State

ZIP code

City

State

ZIP code

Mark an X in the appropriate boxes below:

(See definitions for resident, nonresident, and part-year resident on the back of this form.)

Part 1 — New York State

I certify that I am not a resident of New York State and that my residence is as stated above.

I estimate that

% of my services during the year will be performed within New York State and subject to New York

State withholding tax.

Part 2 — New York City

I certify that I am not a resident of New York City and that my residence is as stated above.

Part 3 — Yonkers

I certify that I am not a resident of Yonkers and that my residence is as stated above.

I estimate that

% of my services during the year will be performed within Yonkers.

I will notify my employer within 10 days of any change in the percentage of my services performed within New York State

or Yonkers, or of a change in my status from nonresident to resident of New York State, New York City, or Yonkers.

Employee’s signature

Date

Employer: You must withhold the applicable amount of New York State, New York City, or Yonkers tax from wages (or

from the percentage of wages shown above) paid to employees who file this certificate. Keep this certificate with your

records. You must keep this certificate and have it available for inspection by the Tax Department.

1

1 2

2