Print

Clear

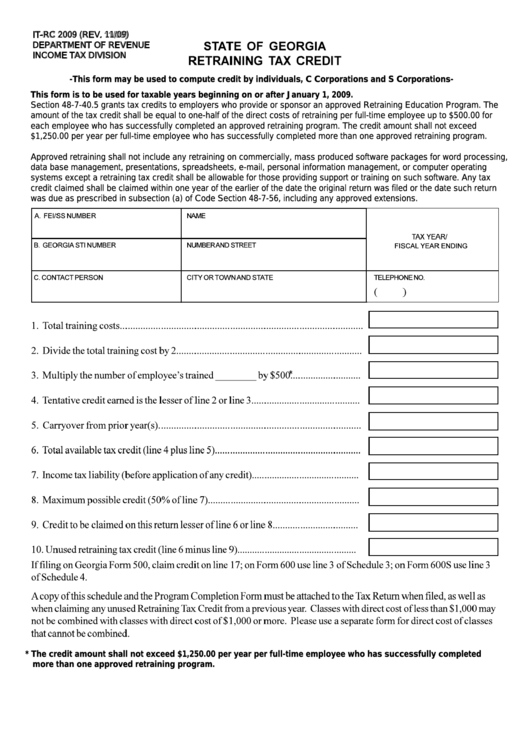

IT-RC 2009 (REV. 11/09)

DEPARTMENT OF REVENUE

INCOME TAX DIVISION

-This form may be used to compute credit by individuals, C Corporations and S Corporations-

This form is to be used for taxable years beginning on or after January 1, 2009.

Section 48-7-40.5 grants tax credits to employers who provide or sponsor an approved Retraining Education Program. The

amount of the tax credit shall be equal to one-half of the direct costs of retraining per full-time employee up to $500.00 for

each employee who has successfully completed an approved retraining program. The credit amount shall not exceed

$1,250.00 per year per full-time employee who has successfully completed more than one approved retraining program.

Approved retraining shall not include any retraining on commercially, mass produced software packages for word processing,

data base management, presentations, spreadsheets, e-mail, personal information management, or computer operating

systems except a retraining tax credit shall be allowable for those providing support or training on such software. Any tax

credit claimed shall be claimed within one year of the earlier of the date the original return was filed or the date such return

was due as prescribed in subsection (a) of Code Section 48-7-56, including any approved extensions.

*

* The credit amount shall not exceed $1,250.00 per year per full-time employee who has successfully completed

more than one approved retraining program.

1

1