Form It-Rd - Research Tax Credit

ADVERTISEMENT

IT-RD 2009 (1/10)

Department of Revenue

Taxpayer Services Division

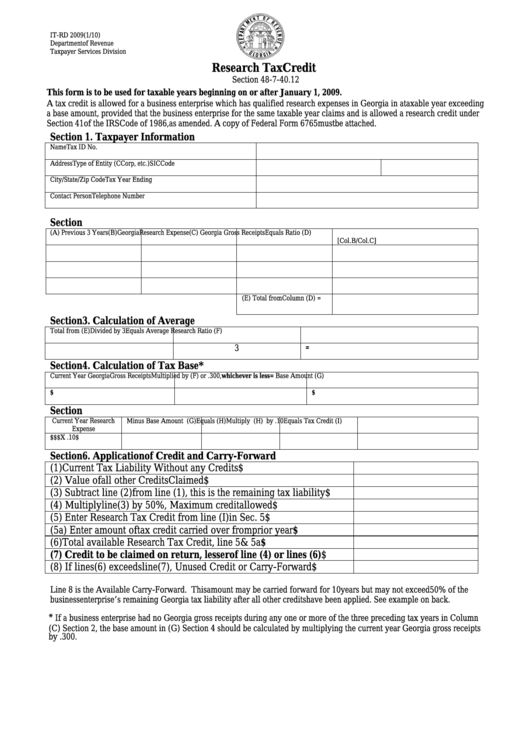

Research Tax Credit

Section 48-7-40.12

This form is to be used for taxable years beginning on or after January 1, 2009.

A tax credit is allowed for a business enterprise which has qualified research expenses in Georgia in a taxable year exceeding

a base amount, provided that the business enterprise for the same taxable year claims and is allowed a research credit under

Section 41 of the IRS Code of 1986, as amended. A copy of Federal Form 6765 must be attached.

Section 1. Taxpayer Information

Name

Tax ID No.

Address

Type of Entity (C Corp, etc.)

SIC Code

City/State/Zip Code

Tax Year Ending

Contact Person

Telephone Number

Section 2. Ratio Calculation

(A) Previous 3 Years

(B) Georgia Research Expense

(C) Georgia Gross Receipts

Equals Ratio (D)

[Col.B/Col.C]

(E) Total from Column (D) =

Section 3. Calculation of Average

Total from (E)

Divided by 3

Equals Average Research Ratio (F)

3

=

Section 4. Calculation of Tax Base*

Current Year Georgia Gross Receipts

Multiplied by (F) or .300, whichever is less

= Base Amount (G)

$

$

Section 5. Calculation of Tax Credit

Current Year Research

Minus Base Amount (G)

Equals (H)

Multiply (H) by .10

Equals Tax Credit (I)

Expense

$

$

$

X .10

$

Section 6. Application of Credit and Carry-Forward

(1) Current Tax Liability Without any Credits

$

(2) Value of all other Credits Claimed

$

(3) Subtract line (2) from line (1), this is the remaining tax liability

$

(4) Multiply line (3) by 50%, Maximum credit allowed

$

(5) Enter Research Tax Credit from line (I) in Sec. 5

$

(5a) Enter amount of tax credit carried over from prior year

$

(6) Total available Research Tax Credit, line 5 & 5a

$

(7) Credit to be claimed on return, lesser of line (4) or lines (6)

$

(8) If lines (6) exceeds line (7), Unused Credit or Carry-Forward

$

Line 8 is the Available Carry-Forward. This amount may be carried forward for 10 years but may not exceed 50% of the

business enterprise’s remaining Georgia tax liability after all other credits have been applied. See example on back.

*

If a business enterprise had no Georgia gross receipts during any one or more of the three preceding tax years in Column

(C) Section 2, the base amount in (G) Section 4 should be calculated by multiplying the current year Georgia gross receipts

by .300.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2