Form Dr 1316 - Colorado Source Capital Gain Affidavit Page 2

ADVERTISEMENT

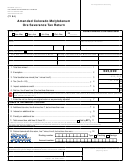

DR 1316 (09/27/10)

COLORADO DEPARTMENT OF REVENUE

DENVER, CO 80261

COLORADO SOURCE CAPITAL GAIN AFFIDAVIT

This form must be completely and accurately filled out to avoid requests for additional information and/or delays in processing your refund.

Taxpayer Name

Social Security Number or Colorado Account Number

Spouse Name (if applicable)

Social Security Number

Provide the following information for each asset that qualifies under the requirements of the Colorado capital gain subtraction. Include any assets that

resulted in a capital loss. Attach federal schedules and/or detailed explanation if needed. Attach additional sheets if needed.

A. Provide a brief description of the nature of the capital gain(s). Include complete address of real property.

1. _____________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________

2. _____________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________

B. If the gain is due to an installment sale, give the date of the original sale and attach a copy of Federal Form 6252 to this form.

**Note** If the sale was prior to 1999, it does not qualify for the capital gain subtraction.

1. ________________________________________________________

2. ________________________________________________________

C. If the gain is due to the sale of stock, list the qualifying property and payroll factors of the corporation for five consecutive years.

1

2

Year

Year

Year

Year

Year

Year

Year

Year

Year

Year

Property

Property

Property

Property

Property

Property

Property

Property

Property

Property

%

%

%

%

%

%

%

%

%

%

Payroll

Payroll

Payroll

Payroll

Payroll

Payroll

Payroll

Payroll

Payroll

Payroll

%

%

%

%

%

%

%

%

%

%

D. If the gain is being passed-through from another entity, list the name and account number of the pass-through entity and the length of time the

taxpayer had ownership interest in the entity.

Entity

Entity

1

2

Ownership Interest (length of time)

Ownership Interest (length of time)

Account Number

Account Number

E. Additional Information (must be completed)

**Note** When the sale of a sole proprietorship or business interest is treated as a sale of assets on the federal return, you must report the

assets sold on this form (attach additional pages if necessary). Each asset must meet the capital gain subtraction requirements to qualify.

Intangibles such as goodwill do not qualify.

(a)

(b)

(c)

(d)

(e)

(f)

Date Acquired

(mo., day, yr)

(mo., day, yr)

Property

Date Sold

Sale Price

Cost or other basis

Gain or loss

1.

.00

.00

.00

2.

.00

.00

.00

.00

3. Total Gain or (Loss) ..................................................................................................................................................................

.00

4. Net Capital Gain or (Loss) as reported on Federal Form 1040 or 1040A .................................................................................

MAXIMUM SUBTRACTION IS $100,000 FOR TAX YEARS BEGINNING ON OR AFTER JANUARY 1, 2010

5. Colorado Source Capital Gain Subtraction, enter lesser of lines 3, 4 or $100,000 for tax years beginning on or after

.00

January 1, 2010. Enter here and on Form 104. .......................................................................................................................

Qualifying Colorado Source Capital Gains and Losses

I attest that the taxpayer(s) shown above has no overdue state tax liabilities and is not in default on any contractual obligations owed to the state or to

any local government within Colorado at the time the attached income tax return is being filed. Under penalties of perjury, I declare that to the best of my

knowledge and belief, this affidavit is true, correct and complete

Signature, Taxpayer or Duly Authorized Individual

Date

Spouse Signature (if joint return, both must sign)

Date

INCLUDE A COPY OF FEDERAL SCHEDULE D AND/OR FORM 4797 WITH THIS FORM.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2