Instructions For Pit-110 Adjustments To New Mexico Income

ADVERTISEMENT

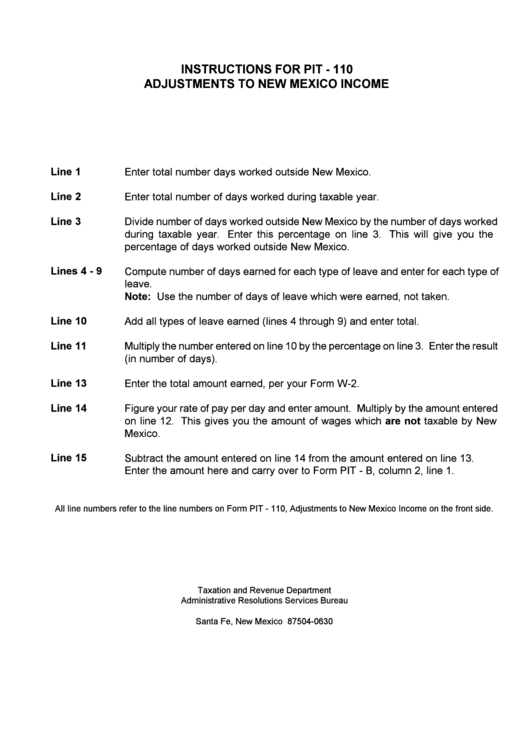

INSTRUCTIONS FOR PIT - 110

ADJUSTMENTS TO NEW MEXICO INCOME

Line 1

Enter total number days worked outside New Mexico.

Line 2

Enter total number of days worked during taxable year.

Line 3

Divide number of days worked outside New Mexico by the number of days worked

during taxable year. Enter this percentage on line 3. This will give you the

percentage of days worked outside New Mexico.

Lines 4 - 9

Compute number of days earned for each type of leave and enter for each type of

leave.

Note: Use the number of days of leave which were earned, not taken.

Line 10

Add all types of leave earned (lines 4 through 9) and enter total.

Line 11

Multiply the number entered on line 10 by the percentage on line 3. Enter the result

(in number of days).

Line 13

Enter the total amount earned, per your Form W-2.

Line 14

Figure your rate of pay per day and enter amount. Multiply by the amount entered

on line 12. This gives you the amount of wages which are not taxable by New

Mexico.

Line 15

Subtract the amount entered on line 14 from the amount entered on line 13.

Enter the amount here and carry over to Form PIT - B, column 2, line 1.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1