Business Personal Property • Petroleum Related - Page 2

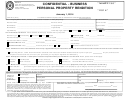

Part Four: Additions During the Reporting Year

Year Acquired

Item

Item Description

Total Acquisition

Number

New

Used

TOTAL

Part Five: Deletions During the Reporting Year

Year Acquired

Item

Item Description

Total Acquisition

Number

New

Used

TOTAL

Part Six: Monthly Inventory

January

February

March

April

May

June

Average

▼

▼

July

August

September

October

November

December

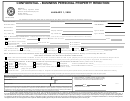

Form 901-P Instructions

Who Must File:

Tools, Machinery and Equipment:

All business concerns, corporations, partnerships or individuals are required by Oklahoma

Fuel in storage, gas in storage, tanks, pumps, signs, miscellaneous tools, power equipment, fork lifts,

law to file each year a statement of taxable assets as of January 1, that are located in this

mobile yard cranes, tractors, non-tagged vehicles or trailers, drilling rig equipment and other such

county and are not specifically exempt from ad valorem taxation by payment of gross

items which are not otherwise specifically exempt from ad valorem taxation by payment of gross

production tax. The rendition must be signed by an owner, partner, or officer of the business

production tax. Do not list current licensed and tagged vehicles.

concern or designated agent.

Meters:

What is Included:

Meters, regulators or devices and all related items used to measure oil, natural gas, carbon dioxide,

Taxable assets rendered on this form should only include those assets that are not exempt by pay-

or liquid hydrocarbons which are not otherwise specifically exempt from ad valorem taxation by pay-

ment of gross production tax. The Tax Commission has published rule 710:10-8 concerning property

ment of gross production tax.

Pipeline:

eligible for exemption from ad valorem taxation pursuant to the provisions in paragraphs (R) and (S)

of Section 1001 of Title 68. Both the rule and statutory reference can be found on the OTC website:

List the size and length of pipe used in the gathering or transmission of oil, natural gas, carbon diox-

They may also be obtained from the Ad Valorem Tax Division.

ide, liquid hydrocarbons or other such products. This will include steel, PVC, polyethylene, including

Penalties:

any pipe, wrappings, coatings, protection devices, and other costs directly or indirectly related to the

Failure to file by March 15 will subject the taxpayer to a mandatory penalty of ten (10) percent, or a

asset, which are not otherwise specifically exempt from ad valorem taxation by payment of gross

twenty (20) percent penalty if not filed by April 15th (68 O.S. Section 2836 (C). Any omitted property

production tax.

pursuant to 68 O.S. Sections 2843 and 2844 shall also be subject to penalty and interest from the

Booster/Compressor Stations:

time of discovery not to exceed fifteen (15) years on real property and three (3) years on personal

Compressor stations including tanks, pipe, valves, measuring or regulatory devices or other related

property.

equipment not used for production purposes at the well site and not specifically exempt from ad

Taxpayers Filing Form 901-P:

valorem taxation by payment of gross production tax.

Attach a complete detailed listing of all taxable assets grouped by description, year acquired

Valve Stations:

and total acquisition cost. Use OTC Schedule 904-3-P for individual assets located in specific

Valves or groups of valves used in the collection, distribution, gathering or transmission of oil, natural

school districts. The form is available on the OTC website: , from the county

gas, carbon dioxide, or any other liquid hydrocarbons. Include launchers, receivers, meters, tanks,

assessor or the Ad Valorem Division.

pipe and other related equipment which are not specifically exempt from ad valorem taxation by pay-

North American Industry Classification Code (N.A.I.C.S.)

ment of gross production tax.

Leased from Others:

This is the six digit Federal Business Activity Code. If unknown, this code may be obtained from the

federal publication of the same name, the Ad Valorem Division, U.S. Department of Census website:

Leased assets which are leased to others and are not specifically used in the production process and

or search keyword NAICS.

are not exempt from ad valorem tax by payment of gross production tax. List lessee, address, asset

Total Acquisition Cost:

type, description, total acquisition cost and age at acquisition. Additional pages may be attached to

Report the total new or used cost at time of acquisition. This will include all direct and indirect costs

this form or OTC Form 904-3-P if necessary.

Inventories:

associated with the asset. Components used to estimate total acquisition cost may include but not be

limited to repair or reconditioning of an asset to place the asset in working condition.

Add the total monthly inventories. Divide the sum by the number of months in business for the year

Year Acquired...

to determine the average inventory. Inventories held for others or consigned must be reported sepa-

Acquisition or purchase date, new or used. Depreciation cannot be correctly calculated without the

rately. Inventory which may be exempt must be claimed on the Freeport Exemption Form OTC 901-F

acquisition date.

which should be filed with the OTC Form 901-P.

Leasehold Improvements...

If the Business is Sold, Closed or Name Changed:

Report total cost and a detailed description of improvements to property owned by others. Do not

To avoid possible incorrect or duplicate assessment, taxpayers should provide information as follows:

report building expansions or repairs that are otherwise included in the real estate value of the build-

• Business Sold: Date of sale, name and address of new owner.

ing. Report only those improvements that are “tenant” specific. This may include interior modifications

• Business Closed: Date of closing and date that all personal property was disposed. Report the

such as partitions, lighting, electrical, suspended ceilings, etc.

location and total value of any remaining personal property still owned on the assessment date of

Furniture and Fixtures:

January 1. This will also include any assets in storage.

Office desks, chairs, credenzas, file cabinets, tables, booths, modular cubicles, book cases, racks

• Business Name Change: Date of name change and new name.

and other such items.

Any detailed information that could clarify any of the above events should be included.

Office Equipment:

School District:

Calculators, copiers, blueprint machines, plotters, fax machines, shredders, postage machines,

For distribution of values to the appropriate school districts, use the OTC 904-3-P when reporting

telephone equipment, lunch room or kitchen appliances and other such items.

individual assets located in different school districts. The OTC Form 901-P is the total asset reporting

Computer Equipment:

form for the business entity.

Items included: computer hardware, monitors, drives, and other such hardware components. Custom

Maps:

software is exempt as an intangible.

Enclose a detailed map noting the location of all taxable assets. This is especially important in the

Processing Plants:

case of various taxable pipeline systems for correct assessment.

Intangible Business Personal Property:

Any refinery, gas extraction, purification or other such processing facilities, including all equipment

used in the processing of oil, natural gas, carbon dioxide or other liquid hydrocarbons which are not

If any intangible property is imbedded in the reported assets the intangible property must be identified

otherwise specifically exempt from ad valorem taxation by payment of gross production tax.

and valued to the county assessor with an impairment study or other such professionally prepared

justification. Supplemental Form 901-IP must be used for any submission.

1

1 2

2