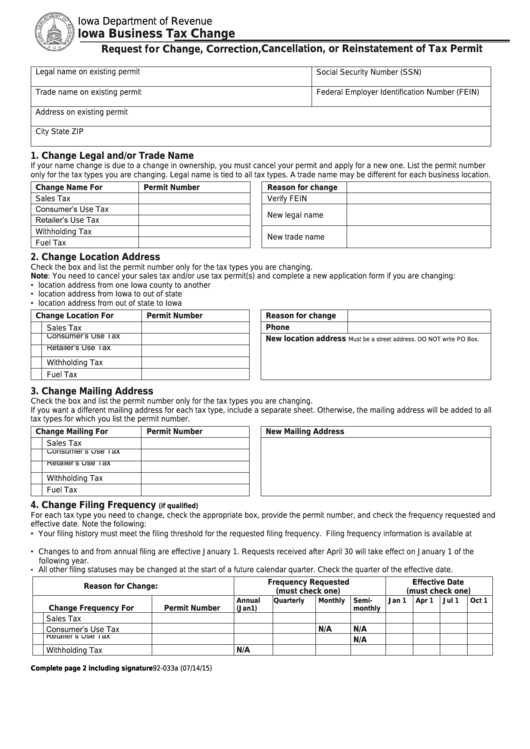

Iowa Department of Revenue

Iowa Business Tax Change

https://tax.iowa.gov

Request for Change, Correction, Cancellation, or Reinstatement of Tax Permit

Legal name on existing permit

Social Security Number (SSN)

Trade name on existing permit

Federal Employer Identification Number (FEIN)

Address on existing permit

City

State

ZIP

1. Change Legal and/or Trade Name

If your name change is due to a change in ownership, you must cancel your permit and apply for a new one. List the permit number

only for the tax types you are changing. Legal name is tied to all tax types. A trade name may be different for each business location.

Change Name For

Permit Number

Reason for change

Sales Tax

Verify FEIN

Consumer’s Use Tax

New legal name

Retailer’s Use Tax

Withholding Tax

New trade name

Fuel Tax

2. Change Location Address

Check the box and list the permit number only for the tax types you are changing.

Note: You need to cancel your sales tax and/or use tax permit(s) and complete a new application form if you are changing:

• location address from one Iowa county to another

• location address from Iowa to out of state

• location address from out of state to Iowa

Change Location For

Permit Number

Reason for change

Phone

Sales Tax

Consumer’s Use Tax

New location address

Must be a street address. DO NOT write PO Box.

Retailer’s Use Tax

Withholding Tax

Fuel Tax

3. Change Mailing Address

Check the box and list the permit number only for the tax types you are changing.

If you want a different mailing address for each tax type, include a separate sheet. Otherwise, the mailing address will be added to all

tax types for which you list the permit number.

Change Mailing For

Permit Number

New Mailing Address

Sales Tax

Consumer’s Use Tax

Retailer’s Use Tax

Withholding Tax

Fuel Tax

4. Change Filing Frequency

(if qualified)

For each tax type you need to change, check the appropriate box, provide the permit number, and check the frequency requested and

effective date. Note the following:

• Your filing history must meet the filing threshold for the requested filing frequency. Filing frequency information is available at

https://tax.iowa.gov under businesses and due dates.

• Changes to and from annual filing are effective January 1. Requests received after April 30 will take effect on January 1 of the

following year.

•

All other filing statuses may be changed at the start of a future calendar quarter. Check the quarter of the effective date.

Frequency Requested

Effective Date

Reason for Change:

(must check one)

(must check one)

Annual

Quarterly

Monthly

Semi-

Jan 1

Apr 1

Jul 1

Oct 1

Change Frequency For

Permit Number

(Jan1)

monthly

Sales Tax

Consumer’s Use Tax

N/A

N/A

Retailer’s Use Tax

N/A

Withholding Tax

N/A

Complete page 2 including signature

92-033a (07/14/15)

1

1 2

2