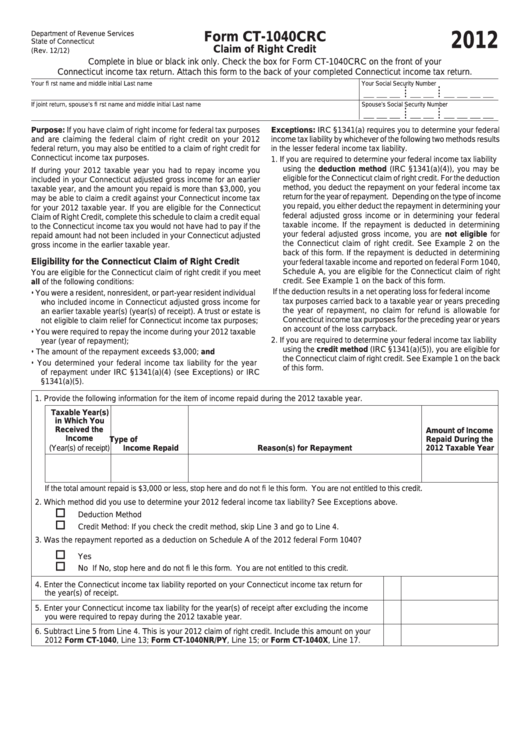

Department of Revenue Services

Form CT-1040CRC

2012

State of Connecticut

Claim of Right Credit

(Rev. 12/12)

Complete in blue or black ink only. Check the box for Form CT-1040CRC on the front of your

Connecticut income tax return. Attach this form to the back of your completed Connecticut income tax return.

Your fi rst name and middle initial

Last name

Your Social Security Number

•

•

__ __ __ __ __ __ __ __ __

• •

•

•

•

•

If joint return, spouse’s fi rst name and middle initial

Last name

Spouse’s Social Security Number

•

•

__ __ __ __ __ __ __ __ __

•

•

•

•

•

•

Purpose: If you have claim of right income for federal tax purposes

Exceptions: IRC §1341(a) requires you to determine your federal

and are claiming the federal claim of right credit on your 2012

income tax liability by whichever of the following two methods results

federal return, you may also be entitled to a claim of right credit for

in the lesser federal income tax liability.

Connecticut income tax purposes.

1. If you are required to determine your federal income tax liability

using the deduction method (IRC §1341(a)(4)), you may be

If during your 2012 taxable year you had to repay income you

eligible for the Connecticut claim of right credit. For the deduction

included in your Connecticut adjusted gross income for an earlier

method, you deduct the repayment on your federal income tax

taxable year, and the amount you repaid is more than $3,000, you

return for the year of repayment. Depending on the type of income

may be able to claim a credit against your Connecticut income tax

you repaid, you either deduct the repayment in determining your

for your 2012 taxable year. If you are eligible for the Connecticut

federal adjusted gross income or in determining your federal

Claim of Right Credit, complete this schedule to claim a credit equal

taxable income. If the repayment is deducted in determining

to the Connecticut income tax you would not have had to pay if the

your federal adjusted gross income, you are not eligible for

repaid amount had not been included in your Connecticut adjusted

the Connecticut claim of right credit. See Example 2 on the

gross income in the earlier taxable year.

back of this form. If the repayment is deducted in determining

Eligibility for the Connecticut Claim of Right Credit

your federal taxable income and reported on federal Form 1040,

Schedule A, you are eligible for the Connecticut claim of right

You are eligible for the Connecticut claim of right credit if you meet

credit. See Example 1 on the back of this form.

all of the following conditions:

If the deduction results in a net operating loss for federal income

• You were a resident, nonresident, or part-year resident individual

tax purposes carried back to a taxable year or years preceding

who included income in Connecticut adjusted gross income for

the year of repayment, no claim for refund is allowable for

an earlier taxable year(s) (year(s) of receipt). A trust or estate is

Connecticut income tax purposes for the preceding year or years

not eligible to claim relief for Connecticut income tax purposes;

on account of the loss carryback.

• You were required to repay the income during your 2012 taxable

2. If you are required to determine your federal income tax liability

year (year of repayment);

using the credit method (IRC §1341(a)(5)), you are eligible for

• The amount of the repayment exceeds $3,000; and

the Connecticut claim of right credit. See Example 1 on the back

• You determined your federal income tax liability for the year

of this form.

of repayment under IRC §1341(a)(4) (see Exceptions) or IRC

§1341(a)(5).

1. Provide the following information for the item of income repaid during the 2012 taxable year.

Taxable Year(s)

in Which You

Received the

Amount of Income

Income

Repaid During the

Type of

2012 Taxable Year

(Year(s) of receipt)

Income Repaid

Reason(s) for Repayment

If the total amount repaid is $3,000 or less, stop here and do not fi le this form. You are not entitled to this credit.

2. Which method did you use to determine your 2012 federal income tax liability? See Exceptions above.

Deduction Method

Credit Method: If you check the credit method, skip Line 3 and go to Line 4.

3. Was the repayment reported as a deduction on Schedule A of the 2012 federal Form 1040?

Yes

No If No, stop here and do not fi le this form. You are not entitled to this credit.

4. Enter the Connecticut income tax liability reported on your Connecticut income tax return for

the year(s) of receipt. ........................................................................................................................

4.

5. Enter your Connecticut income tax liability for the year(s) of receipt after excluding the income

you were required to repay during the 2012 taxable year. ...............................................................

5.

6. Subtract Line 5 from Line 4. This is your 2012 claim of right credit. Include this amount on your

2012 Form CT-1040, Line 13; Form CT-1040NR/PY, Line 15; or Form CT-1040X, Line 17. .........

6.

1

1 2

2