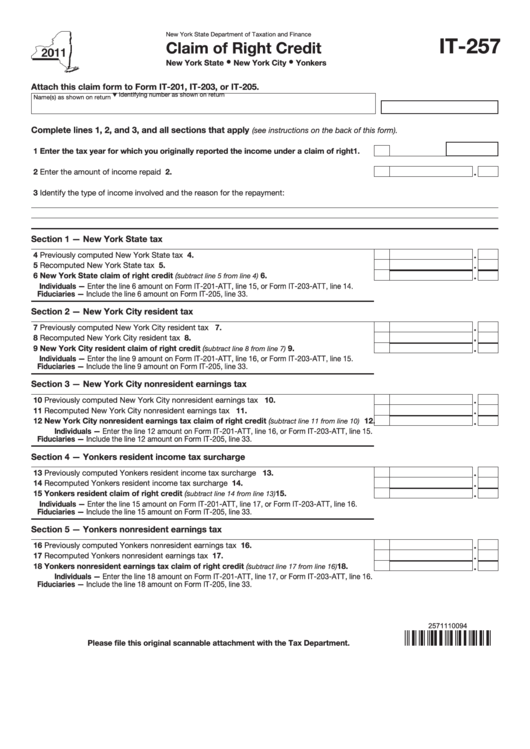

New York State Department of Taxation and Finance

IT-257

Claim of Right Credit

•

•

New York State

New York City

Yonkers

Attach this claim form to Form IT-201, IT-203, or IT-205.

Identifying number as shown on return

Name(s) as shown on return

Complete lines 1, 2, and 3, and all sections that apply

(see instructions on the back of this form).

1 Enter the tax year for which you originally reported the income under a claim of right ....

1.

2 Enter the amount of income repaid ..............................................................................................

2.

3 Identify the type of income involved and the reason for the repayment:

Section 1 — New York State tax

4 Previously computed New York State tax ....................................................................................

4.

5 Recomputed New York State tax .................................................................................................

5.

6 New York State claim of right credit (s

.................................................

6.

ubtract line 5 from line 4)

Individuals — Enter the line 6 amount on Form IT-201-ATT, line 15, or Form IT-203-ATT, line 14.

Fiduciaries — Include the line 6 amount on Form IT-205, line 33.

Section 2 — New York City resident tax

7 Previously computed New York City resident tax .......................................................................

7.

8 Recomputed New York City resident tax .....................................................................................

8.

9 New York City resident claim of right credit (s

....................................

9.

ubtract line 8 from line 7)

Individuals — Enter the line 9 amount on Form IT-201-ATT, line 16, or Form IT-203-ATT, line 15.

Fiduciaries — Include the line 9 amount on Form IT-205, line 33.

Section 3 — New York City nonresident earnings tax

10 Previously computed New York City nonresident earnings tax .................................................. 10.

11 Recomputed New York City nonresident earnings tax ............................................................... 11.

12 New York City nonresident earnings tax claim of right credit (s

12.

ubtract line 11 from line 10) .....

Individuals — Enter the line 12 amount on Form IT-201-ATT, line 16, or Form IT-203-ATT, line 15.

Fiduciaries — Include the line 12 amount on Form IT-205, line 33.

Section 4 — Yonkers resident income tax surcharge

13 Previously computed Yonkers resident income tax surcharge ................................................... 13.

14 Recomputed Yonkers resident income tax surcharge ................................................................. 14.

15 Yonkers resident claim of right credit (s

........................................... 15.

ubtract line 14 from line 13)

Individuals — Enter the line 15 amount on Form IT-201-ATT, line 17, or Form IT-203-ATT, line 16.

Fiduciaries — Include the line 15 amount on Form IT-205, line 33.

Section 5 — Yonkers nonresident earnings tax

16 Previously computed Yonkers nonresident earnings tax ............................................................. 16.

17 Recomputed Yonkers nonresident earnings tax .......................................................................... 17.

18 Yonkers nonresident earnings tax claim of right credit (s

.............. 18.

ubtract line 17 from line 16)

Individuals — Enter the line 18 amount on Form IT-201-ATT, line 17, or Form IT-203-ATT, line 16.

Fiduciaries — Include the line 18 amount on Form IT-205, line 33.

2571110094

Please file this original scannable attachment with the Tax Department.

1

1 2

2