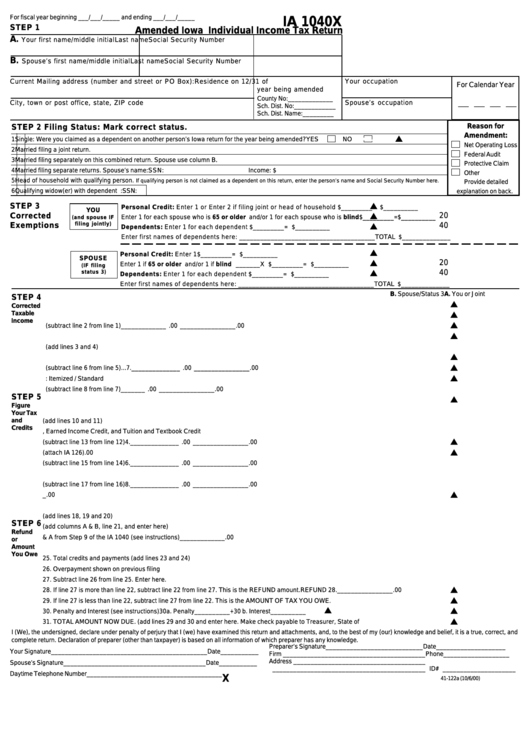

Form Ia 1040x - Amended Iowa Individual Income Tax Return - 2000

ADVERTISEMENT

For fiscal year beginning ___/___/_____ and ending ___/___/_____

IA 1040X

STEP 1

Amended Iowa Individual Income Tax Return

A.

Your first name/middle initial

Last name

Social Security Number

B.

Spouse’s first name/middle initial

Last name

Social Security Number

Current Mailing address (number and street or PO Box):

Residence on 12/31 of

Your occupation

For Calendar Year

year being amended

County No: _____________

__ __ __ __

Spouse’s occupation

City, town or post office, state, ZIP code

Sch. Dist. No: ____________

Sch. Dist. Name: _________

Reason for

STEP 2 Filing Status: Mark correct status.

Amendment:

s

1

Single: Were you claimed as a dependent on another person’s Iowa return for the year being amended?

YES

NO

NONNO

Net Operating Loss

2

Married filing a joint return.

Federal Audit

3

Married filing separately on this combined return. Spouse use column B.

Protective Claim

4

Married filing separate returns. Spouse’s name:

SSN:

Income: $

Other

5

Head of household with qualifying person.

If qualifying person is not claimed as a dependent on this return, enter the person’s name and Social Security Number here.

Provide detailed

6

Qualifying widow(er) with dependent child.

Name:

SSN:

explanation on back.

s

STEP 3

Personal Credit: Enter 1 or Enter 2 if filing joint or head of household ...................... _______

X $ _________ = $ __________

YOU

s

Corrected

20

Enter 1 for each spouse who is 65 or older and/or 1 for each spouse who is blind ........ _______

X $ _________ = $ __________

(and spouse IF

s

filing jointly)

Exemptions

40

Dependents: Enter 1 for each dependent ......................................................................... _______

X $ _________ = $ __________

Enter first names of dependents here: _______________________________________

TOTAL $ ______________

s

Personal Credit: Enter 1 ...................................................................................................... _______

X $ _________ = $ __________

SPOUSE

s

20

Enter 1 if 65 or older and/or 1 if blind .................................................................................. _______

X $ _________ = $ __________

(IF filing

s

status 3)

40

Dependents: Enter 1 for each dependent ......................................................................... _______

X $ _________ = $ __________

Enter first names of dependents here: _______________________________________

TOTAL $ ______________

B. Spouse/Status 3

A. You or Joint

STEP 4

s

1. Gross Income ....................................................................................................................................................................... 1. ______________ .00 ________________ .00

Corrected

s

Taxable

2. Adjustments to Income ........................................................................................................................................................ 2. ______________ .00 ________________ .00

Income

s

3. Net Income (subtract line 2 from line 1) ............................................................................................................................ 3. ______________ .00 ________________ .00

s

4. Addition for Federal Taxes ................................................................................................................................................. 4. ______________ .00 ________________ .00

5. Total (add lines 3 and 4) .................................................................................................................................................... 5. ______________ .00 ________________ .00

s

6. Deduction for Federal Taxes .............................................................................................................................................. 6. ______________ .00 ________________ .00

s

7. Balance (subtract line 6 from line 5) .................................................................................................................................. 7. ______________ .00 ________________ .00

s

8. Deduction: Itemized / Standard ......................................................................................................................................... 8. ______________ .00 ________________ .00

9. Taxable Income (subtract line 8 from line 7) ...................................................................................................................... 9. ______________ .00 ________________ .00

STEP 5

s

10. Tax or Alternative Tax ........................................................................................................................................................ 10. ______________ .00 ________________ .00

Figure

11. Iowa Lump Sum/Minimum Tax ........................................................................................................................................... 11. ______________ .00 ________________ .00

Your Tax

and

12. Total Tax (add lines 10 and 11) .......................................................................................................................................... 12. ______________ .00 ________________ .00

Credits

13. Total of Exemption Credits, Earned Income Credit, and Tuition and Textbook Credit ...................................................... 13. ______________ .00 ________________ .00

s

14. Balance (subtract line 13 from line 12) .............................................................................................................................. 14. ______________ .00 ________________ .00

s

15. Credit for Nonresident or Part-Year Resident (attach IA 126) ........................................................................................... 15. ______________ .00 ________________ .00

16. Balance (subtract line 15 from line 14) .............................................................................................................................. 16. ______________ .00 ________________ .00

17. Other Iowa Credits ............................................................................................................................................................. 17. ______________ .00 ________________ .00

18. Balance (subtract line 17 from line 16) .............................................................................................................................. 18. ______________ .00 ________________ .00

s

19. School District Surtax/Emergency Medical Services Surtax ............................................................................................ 19. ______________ .00 ________________ .00

20. Contributions from Original Return .................................................................................................................................... 20. ______________ .00 ________________ .00

21. Total Tax (add lines 18, 19 and 20) .................................................................................................................................... 21. ______________ .00 ________________ .00

STEP 6

22. Total (add columns A & B, line 21, and enter here) .............................................................................................................................................. 22. ________________ .00

Refund

23. Total credits B & A from Step 9 of the IA 1040 (see instructions) ......................................................................................................................... 23. ________________ .00

or

Amount

24. Tax amount previously paid ................................................................................................................................................................................... 24. ________________ .00

You Owe

25. Total credits and payments (add lines 23 and 24) .................................................................................................................................................. 25. ________________ .00

26. Overpayment shown on previous filing .................................................................................................................................................................. 26. ________________ .00

27. Subtract line 26 from line 25. Enter here. ............................................................................................................................................................... 27. ________________ .00

s

28. If line 27 is more than line 22, subtract line 22 from line 27. This is the REFUND amount. .............................................................. REFUND

28. ________________ .00

s

29. If line 27 is less than line 22, subtract line 27 from line 22. This is the AMOUNT OF TAX YOU OWE. ................................................................. 29. ________________ .00

s

s

30. Penalty and Interest (see instructions)

30a. Penalty__________

+30 b. Interest__________ .................. 30. ________________ .00

s

31. TOTAL AMOUNT NOW DUE. (add lines 29 and 30 and enter here. Make check payable to Treasurer, State of Iowa .......................... PAY

31. ________________ .00

I (We), the undersigned, declare under penalty of perjury that I (we) have examined this return and attachments, and, to the best of my (our) knowledge and belief, it is a true, correct, and

complete return. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Preparer’s Signature ____________________________ Date ____________________

Your Signature _____________________________________________ Date ___________

Firm _________________________________________ Phone ___________________

Address ______________________________________

Spouse’s Signature _________________________________________ Date ___________

____________________________________________ ID# _____________________

Daytime Telephone Number _______________________________________

X

41-122a (10/6/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2