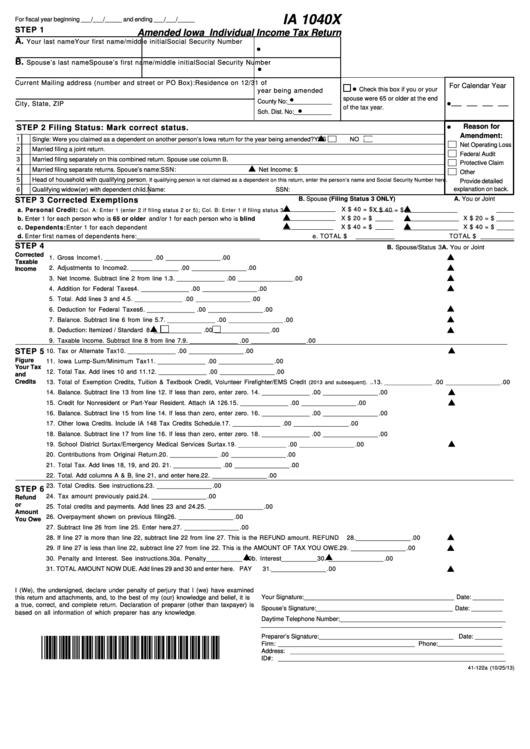

IA 1040X

For fiscal year beginning ___/___/_____ and ending ___/___/_____

STEP 1

Amended Iowa Individual Income Tax Return

A.

Your last name

Your first name/middle initial

Social Security Number

•

B.

Spouse’s last name

Spouse’s first name/middle initial Social Security Number

•

Current Mailing address (number and street or PO Box):

Residence on 12/31 of

For Calendar Year

•

Check this box if you or your

year being amended

•

spouse were 65 or older at the end

__ __ __ __

County No: _____________

•

City, State, ZIP

of the tax year.

•

Sch. Dist. No: ___________

•

Reason for

STEP 2 Filing Status: Mark correct status.

Amendment:

L

1

Single: Were you claimed as a dependent on another person’s Iowa return for the year being amended?

YES

NO

NONNO

Net Operating Loss

2

Married filing a joint return.

Federal Audit

3

Married filing separately on this combined return. Spouse use column B.

Protective Claim

L

4

Married filing separate returns. Spouse’s name:

SSN:

Net Income: $

Other

5

Head of household with qualifying person.

If qualifying person is not claimed as a dependent on this return, enter the person’s name and Social Security Number here.

Provide detailed

explanation on back.

6

Qualifying widow(er) with dependent child.

Name:

SSN:

B. Spouse (Filing Status 3 ONLY)

A. You or Joint

STEP 3 Corrected Exemptions

L

L

X $ 40 = $

a. Personal Credit:

X $ 40 = $

Col. A: Enter 1 (enter 2 if filing status 2 or 5); Col. B: Enter 1 if filing status 3

L

L

X $ 20 = $

X $ 20 = $

b. Enter 1 for each person who is 65 or older and/or 1 for each person who is blind..............

L

L

X $ 40 = $

c. Dependents: Enter 1 for each dependent ...................................................................

X $ 40 = $

d. Enter first names of dependents here: ____________________________________

e. TOTAL $

TOTAL $

STEP 4

B. Spouse/Status 3

A. You or Joint

Corrected

L

1. Gross Income ...................................................................................................................................................................... 1. ______________ .00 ________________ .00

Taxable

L

2. Adjustments to Income ...................................................................................................................................................... 2. ______________ .00 ________________ .00

Income

L

3. Net Income. Subtract line 2 from line 1. ......................................................................................................................... 3. ______________ .00 ________________ .00

L

4. Addition for Federal Taxes .............................................................................................................................................. 4. ______________ .00 ________________ .00

5. Total. Add lines 3 and 4. .................................................................................................................................................. 5. ______________ .00 ________________ .00

L

6. Deduction for Federal Taxes .......................................................................................................................................... 6. ______________ .00 ________________ .00

L

7. Balance. Subtract line 6 from line 5. .............................................................................................................................. 7. ______________ .00 ________________ .00

L

L

8. Deduction: Itemized / Standard ....

Itemized .......

Standard ....................................................................... 8. ______________ .00 ________________ .00

9. Taxable Income. Subtract line 8 from line 7. ................................................................................................................. 9. ______________ .00 ________________ .00

L

STEP 5

10. Tax or Alternate Tax ........................................................................................................................................................ 10. ______________ .00 ________________ .00

Figure

11. Iowa Lump-Sum/Minimum Tax ....................................................................................................................................... 11. ______________ .00 ________________ .00

Your Tax

12. Total Tax. Add lines 10 and 11. ...................................................................................................................................... 12. ______________ .00 ________________ .00

and

Credits

13. Total of Exemption Credits, Tuition & Textbook Credit, Volunteer Firefighter/EMS Credit

.. 13. ______________ .00 ________________ .00

(2013 and subsequent).

L

14. Balance. Subtract line 13 from line 12. If less than zero, enter zero. ......................................................................... 14. ______________ .00 ________________ .00

L

15. Credit for Nonresident or Part-Year Resident. Attach IA 126. ..................................................................................... 15. ______________ .00 ________________ .00

16. Balance. Subtract line 15 from line 14. If less than zero, enter zero. ......................................................................... 16. ______________ .00 ________________ .00

17. Other Iowa Credits. Include IA 148 Tax Credits Schedule. ......................................................................................... 17. ______________ .00 ________________ .00

18. Balance. Subtract line 17 from line 16. If less than zero, enter zero. ......................................................................... 18. ______________ .00 ________________ .00

L

19. School District Surtax/Emergency Medical Services Surtax. ...................................................................................... 19. ______________ .00 ________________ .00

20. Contributions from Original Return. ............................................................................................................................... 20. ______________ .00 ________________ .00

21. Total Tax. Add lines 18, 19, and 20. .............................................................................................................................. 21. ______________ .00 ________________ .00

22. Total. Add columns A & B, line 21, and enter here. ......................................................................................................................................... 22. ________________ .00

23. Total Credits. See instructions. .......................................................................................................................................................................... 23. ________________ .00

STEP 6

24. Tax amount previously paid. ............................................................................................................................................................................. 24. ________________ .00

Refund

or

25. Total credits and payments. Add lines 23 and 24. ........................................................................................................................................... 25. ________________ .00

Amount

26. Overpayment shown on previous filing ............................................................................................................................................................. 26. ________________ .00

You Owe

27. Subtract line 26 from line 25. Enter here. .......................................................................................................................................................... 27. ________________ .00

L

28. If line 27 is more than line 22, subtract line 22 from line 27. This is the REFUND amount. ................................................... REFUND

28. ________________ .00

L

29. If line 27 is less than line 22, subtract line 27 from line 22. This is the AMOUNT OF TAX YOU OWE. ....................................................... 29. ________________ .00

L

L

30. Penalty and Interest. See instructions.

30a. Penalty__________

30b. Interest__________ ....... 30. ________________ .00

L

31. TOTAL AMOUNT NOW DUE. Add lines 29 and 30 and enter here. ....................................................................................... .......... PAY

31. ________________ .00

I (We), the undersigned, declare under penalty of perjury that I (we) have examined

Your Signature: ____________________________________________ Date: _________

this return and attachments, and, to the best of my (our) knowledge and belief, it is

a true, correct, and complete return. Declaration of preparer (other than taxpayer) is

Spouse’s Signature: ________________________________________ Date: _________

based on all information of which preparer has any knowledge.

Daytime Telephone Number:________________________________________________

Preparer’s Signature:_______________________________________ Date: ________

*1341122019999*

Firm: ________________________________________ Phone:

Address: ______________________________________________________________

ID#: __________________________________________________________________

41-122a (10/25/13)

1

1 2

2 3

3 4

4