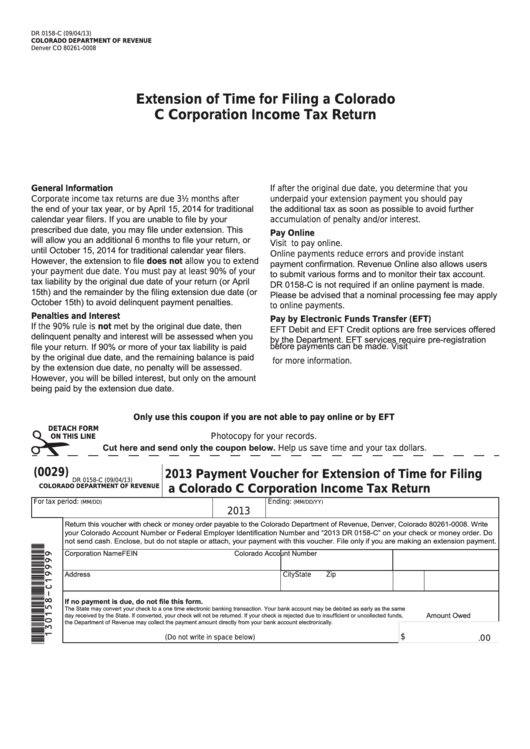

DR 0158-C (09/04/13)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0008

Extension of Time for Filing a Colorado

C Corporation Income Tax Return

General Information

If after the original due date, you determine that you

Corporate income tax returns are due 3½ months after

underpaid your extension payment you should pay

the end of your tax year, or by April 15, 2014 for traditional

the additional tax as soon as possible to avoid further

calendar year filers. If you are unable to file by your

accumulation of penalty and/or interest.

prescribed due date, you may file under extension. This

Pay Online

will allow you an additional 6 months to file your return, or

Visit to pay online.

until October 15, 2014 for traditional calendar year filers.

Online payments reduce errors and provide instant

However, the extension to file does not allow you to extend

payment confirmation. Revenue Online also allows users

your payment due date. You must pay at least 90% of your

to submit various forms and to monitor their tax account.

tax liability by the original due date of your return (or April

DR 0158-C is not required if an online payment is made.

15th) and the remainder by the filing extension due date (or

Please be advised that a nominal processing fee may apply

October 15th) to avoid delinquent payment penalties.

to online payments.

Penalties and Interest

Pay by Electronic Funds Transfer (EFT)

If the 90% rule is not met by the original due date, then

EFT Debit and EFT Credit options are free services offered

delinquent penalty and interest will be assessed when you

by the Department. EFT services require pre-registration

file your return. If 90% or more of your tax liability is paid

before payments can be made. Visit

by the original due date, and the remaining balance is paid

for more information.

by the extension due date, no penalty will be assessed.

However, you will be billed interest, but only on the amount

being paid by the extension due date.

Only use this coupon if you are not able to pay online or by EFT

DETACH FORM

Photocopy for your records.

ON THIS LINE

Cut here and send only the coupon below. Help us save time and your tax dollars.

(0029)

2013 Payment Voucher for Extension of Time for Filing

DR 0158-C (09/04/13)

COLORADO DEPARTMENT OF REVENUE

a Colorado C Corporation Income Tax Return

For tax period:

Ending:

(MM/DD)

(MM/DD/YY)

2013

Return this voucher with check or money order payable to the Colorado Department of Revenue, Denver, Colorado 80261-0008. Write

your Colorado Account Number or Federal Employer Identification Number and “2013 DR 0158-C” on your check or money order. Do

not send cash. Enclose, but do not staple or attach, your payment with this voucher. File only if you are making an extension payment.

Corporation Name

FEIN

Colorado Account Number

Address

City

State

Zip

If no payment is due, do not file this form.

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the same

Amount Owed

day received by the State. If converted, your check will not be returned. If your check is rejected due to insufficient or uncollected funds,

the Department of Revenue may collect the payment amount directly from your bank account electronically.

.0 0

$

(Do not write in space below)

1

1