Form Ct-Uisr -

ADVERTISEMENT

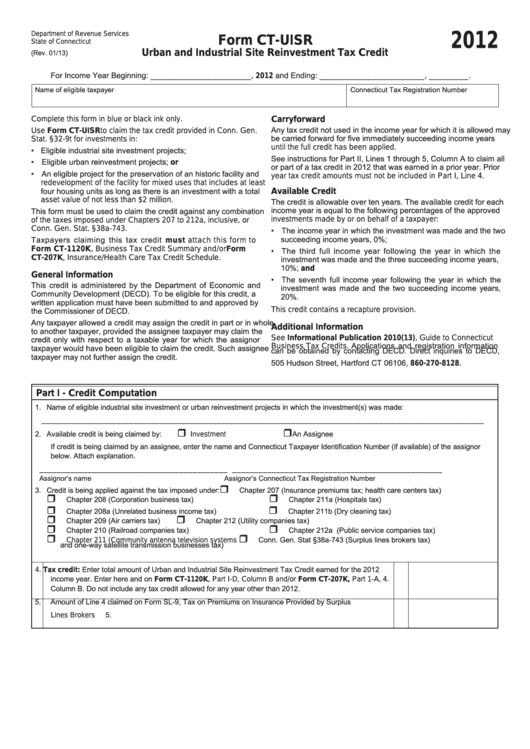

Department of Revenue Services

2012

Form CT-UISR

State of Connecticut

(Rev. 01/13)

Urban and Industrial Site Reinvestment Tax Credit

For Income Year Beginning: _______________________ , 2012 and Ending: ________________________ , _________ .

Name of eligible taxpayer

Connecticut Tax Registration Number

Complete this form in blue or black ink only.

Carryforward

Any tax credit not used in the income year for which it is allowed may

Use Form CT-UISR to claim the tax credit provided in Conn. Gen.

be carried forward for five immediately succeeding income years

Stat. §32-9t for investments in:

until the full credit has been applied.

• Eligible industrial site investment projects;

See instructions for Part II, Lines 1 through 5, Column A to claim all

• Eligible urban reinvestment projects; or

or part of a tax credit in 2012 that was earned in a prior year. Prior

• An eligible project for the preservation of an historic facility and

year tax credit amounts must not be included in Part I, Line 4.

redevelopment of the facility for mixed uses that includes at least

four housing units as long as there is an investment with a total

Available Credit

asset value of not less than $2 million.

The credit is allowable over ten years. The available credit for each

income year is equal to the following percentages of the approved

This form must be used to claim the credit against any combination

investments made by or on behalf of a taxpayer:

of the taxes imposed under Chapters 207 to 212a, inclusive, or

Conn. Gen. Stat. §38a-743.

• The income year in which the investment was made and the two

succeeding income years, 0%;

Taxpayers claiming this tax credit must attach this form to

Form CT-1120K, Business Tax Credit Summary and/or Form

• The third full income year following the year in which the

CT-207K, Insurance/Health Care Tax Credit Schedule.

investment was made and the three succeeding income years,

10%; and

General Information

• The seventh full income year following the year in which the

This credit is administered by the Department of Economic and

investment was made and the two succeeding income years,

Community Development (DECD). To be eligible for this credit, a

20%.

written application must have been submitted to and approved by

the Commissioner of DECD.

This credit contains a recapture provision.

Any taxpayer allowed a credit may assign the credit in part or in whole

Additional Information

to another taxpayer, provided the assignee taxpayer may claim the

credit only with respect to a taxable year for which the assignor

See Informational Publication 2010(13), Guide to Connecticut

Business Tax Credits. Applications and registration information

taxpayer would have been eligible to claim the credit. Such assignee

can be obtained by contacting DECD. Direct inquiries to DECD,

taxpayer may not further assign the credit.

505 Hudson Street, Hartford CT 06106, 860-270-8128.

Part I - Credit Computation

1. Name of eligible industrial site investment or urban reinvestment projects in which the investment(s) was made:

_____________________________________________________________________________________________________

2. Available credit is being claimed by:

An Assignee

Investment

If credit is being claimed by an assignee, enter the name and Connecticut Taxpayer Identification Number (if available) of the assignor

below. Attach explanation.

___________________________________________

________________________________________________

Assignor’s name

Assignor’s Connecticut Tax Registration Number

3. Credit is being applied against the tax imposed under:

Chapter 207 (Insurance premiums tax; health care centers tax)

Chapter 208 (Corporation business tax)

Chapter 211a (Hospitals tax)

Chapter 208a (Unrelated business income tax)

Chapter 211b (Dry cleaning tax)

Chapter 209 (Air carriers tax)

Chapter 212 (Utility companies tax)

Chapter 210 (Railroad companies tax)

Chapter 212a (Public service companies tax)

Conn. Gen. Stat §38a-743 (Surplus lines brokers tax)

Chapter 211 (Community antenna television systems

and one-way satellite transmission businesses tax)

Tax credit: Enter total amount of Urban and Industrial Site Reinvestment Tax Credit earned for the 2012

4.

income year. Enter here and on Form CT-1120K, Part I-D, Column B and/or Form CT-207K, Part 1-A,

4.

Column B. Do not include any tax credit allowed for any year other than 2012.

5. Amount of Line 4 claimed on Form SL-9, Tax on Premiums on Insurance Provided by Surplus

5.

Lines Brokers

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2