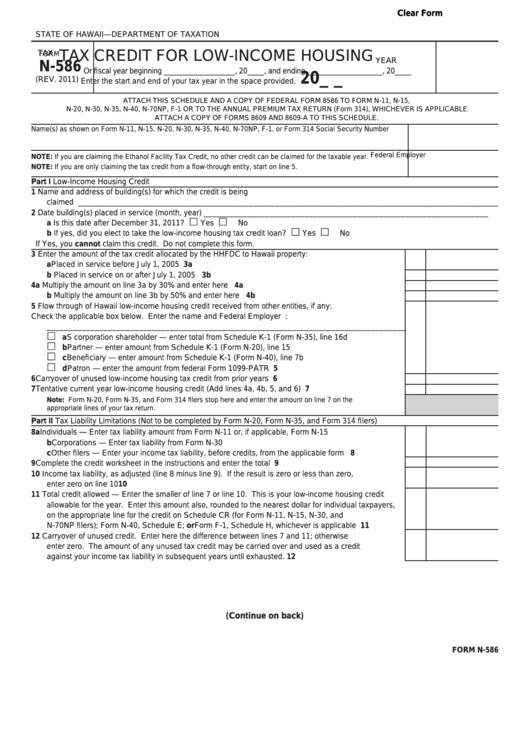

Clear Form

STATE OF HAWAII—DEPARTMENT OF TAXATION

TAX CREDIT FOR LOW-INCOME HOUSING

TAX

FORM

YEAR

N-586

Or fiscal year beginning _________________, 20____, and ending __________________, 20____

20_ _

(REV. 2011)

Enter the start and end of your tax year in the space provided.

ATTACH THIS SCHEDULE AND A COPY OF FEDERAL FORM 8586 TO FORM N-11, N-15,

N-20, N-30, N-35, N-40, N-70NP, F-1 OR TO THE ANNUAL PREMIUM TAX RETURN (Form 314), WHICHEVER IS APPLICABLE.

ATTACH A COPY OF FORMS 8609 AND 8609-A TO THIS SCHEDULE.

Name(s) as shown on Form N-11, N-15, N-20, N-30, N-35, N-40, N-70NP, F-1, or Form 314

Social Security Number

Federal Employer I.D. No.

NOTE: If you are claiming the Ethanol Facility Tax Credit, no other credit can be claimed for the taxable year.

NOTE: If you are only claiming the tax credit from a flow-through entity, start on line 5.

Part I

Low-Income Housing Credit

1

Name and address of building(s) for which the credit is being

claimed ________________________________________________________________________________________________

2

Date building(s) placed in service (month, year) _________________________________________________________________

a

Is this date after December 31, 2011?

Yes

No

b

If yes, did you elect to take the low-income housing tax credit loan?

Yes

No

If Yes, you cannot claim this credit. Do not complete this form.

3

Enter the amount of the tax credit allocated by the HHFDC to Hawaii property:

a

Placed in service before July 1, 2005 .................................................................................................

3a

b

Placed in service on or after July 1, 2005 ...........................................................................................

3b

4

a

Multiply the amount on line 3a by 30% and enter here .......................................................................

4a

b

Multiply the amount on line 3b by 50% and enter here .......................................................................

4b

5

Flow through of Hawaii low-income housing credit received from other entities, if any:

Check the applicable box below. Enter the name and Federal Employer I.D. No. of Entity:

__________________________________________________________________________________

a S corporation shareholder — enter total from Schedule K-1 (Form N-35), line 16d ......................

b Partner — enter amount from Schedule K-1 (Form N-20), line 15 .................................................

c Beneficiary — enter amount from Schedule K-1 (Form N-40), line 7b ...........................................

d Patron — enter the amount from federal Form 1099-PATR ............................................................

5

6

Carryover of unused low-income housing tax credit from prior years ........................................................

6

7

Tentative current year low-income housing credit (Add lines 4a, 4b, 5, and 6) ..........................................

7

Note: Form N-20, Form N-35, and Form 314 filers stop here and enter the amount on line 7 on the

appropriate lines of your tax return.

Part II

Tax Liability Limitations (Not to be completed by Form N-20, Form N-35, and Form 314 filers)

8

a

Individuals — Enter tax liability amount from Form N-11 or, if applicable, Form N-15 ........................

b

Corporations — Enter tax liability from Form N-30 .............................................................................

c

Other filers — Enter your income tax liability, before credits, from the applicable form .....................

8

9

Complete the credit worksheet in the instructions and enter the total here................................................

9

10 Income tax liability, as adjusted (line 8 minus line 9). If the result is zero or less than zero,

enter zero on line 10 ...................................................................................................................................

10

11 Total credit allowed — Enter the smaller of line 7 or line 10. This is your low-income housing credit

allowable for the year. Enter this amount also, rounded to the nearest dollar for individual taxpayers,

on the appropriate line for the credit on Schedule CR (for Form N-11, N-15, N-30, and

N-70NP filers); Form N-40, Schedule E; or Form F-1, Schedule H, whichever is applicable .....................

11

12 Carryover of unused credit. Enter here the difference between lines 7 and 11; otherwise

enter zero. The amount of any unused tax credit may be carried over and used as a credit

against your income tax liability in subsequent years until exhausted. ......................................................

12

(Continue on back)

FORM N-586

1

1 2

2 3

3 4

4