INSTRUCTIONS — IA 2210

A. Purpose of This Form:

federal AGI is $150,000 ($75,000 for married filing separate

federal returns) or less; or (3) 110% of the tax shown on the

If you are an individual taxpayer other than a qualifying

2011 return if their 2011 federal AGI is greater than $150,000

farmer or fisher, you may use this form to determine whether

($75,000 for married filing separate federal r eturns) plus any

your income tax was sufficiently paid throughout the year by

bonus depreciation adjustment.

withholding or by estimated payments. If they were not, you

may owe a penalty. The estimated tax penalty is 5% per year

Their 2011 return must have covered a period of 12 months.

for the tax period January 1, 2012, through December 31,

Line 12 - Tax on Annualized 2012 Income: If your income

2012, and 5% per year for the tax period January 1, 2013,

varies throughout the tax year, you may be able to reduce or

through December 31, 2013. The changes in the estimated tax

eliminate the amount of one or more of the required

penalty apply to amounts arising during these periods. This

installments by using the annualized income installment

form will help you determine whether you are subject to such

method. If you use this method, you must check the box on

a penalty. Taxpayers who did not make any estimated

line 73 of the IA 1040. Please see IA 2210 Schedule AI and

payments, or paid the same amount of estimated tax on each

instructions.

of the four payment due dates, may use the IA 2210S. The IA

Line 13 - If you used the annualized income installment

2210S is a short method of calculating underpayment of

method to figure your required payments, enter the amount

estimated tax by individuals.

from line 12. Otherwise, enter the amount from line 11.

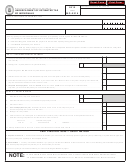

B. Filing an Estimate and Paying the Tax,

Line 14 - Installment payments: Enter your payments or

Calendar Year Taxpayers:

portion of payments needed to satisfy the amount of the

required installment. Your estimated payments and

If you file returns on a calendar-year basis and are required to

withholding are applied to the earliest unpaid installment. It

file form IA 1040ES, you are generally required to pay the tax

does not matter that the payment is designated for a later

in four installments with the first installment due by April 30.

period. Any overpayment is carried to the next unpaid

(If you are not required to file until later in the year because

installment. If additional computations are required beyond

of a change in your income or exemptions, you may be

the three allotted lines on this form, attach a separate sheet for

required to pay in fewer installments.) The chart below shows

each computation.

the due date for installments and the maximum number of

installments required for each.

You may consider an equal part of the income tax withheld

during the year as paid on each required installment date,

Maximum

Period

Due Date

Number of

unless you can establish the dates on which the withholding

Requirements

of

Installments

occurred and consider the tax paid on those dates.

First Met

Installment

Required

Line 15 - Enter the date the payment was made or, if

Between January 1 and April 1

April 30

4

withholding, the due date of the installment. If more than one

Between April 2 and June 1

June 30

3

payment is applied to pay the installment, enter a date for

Between June 2 and September 1 September 30

2

each payment.

After September 1

January 31

1

NOTE: If any date shown falls on a weekend, federal holiday,

Line 16 - To Compute Penalty: Use the following formula:

or legal holiday as defined in Iowa Code section 4.1(34),

Penalty = daily percentage rate x number of days x payment applied

substitute the next regular working day.

(line 17)

(line 16)

(line 14)

LINE-BY-LINE INSTRUCTIONS

T

he daily percentage rate is:

Line 8 - If line 8 is $200 or more, complete lines 9 through

5% per annum = 0.013661% per day (01/01/12 - 12/31/12) The daily

15. If you have an underpayment in any column on line 15, go

rate for 2012 varies because it is a leap year.

to the “How to Figure the Penalty” section.

5% per annum = 0.013699% per day (01/01/13 - 12/31/13)

If the total from line 8 is less than $200, then you are not

Waiver of Penalty: The underpayment of estimated tax

required to pay estimated tax and therefore cannot have

penalty may be waived if the underpayment was due to

underpaid estimated tax. If the total from line 8 is less than

casualty, disaster, or other unusual circumstances. The penalty

$200 do not file form IA 2210.

may also be waived if the taxpayer retired at age 62 or later,

or became disabled in the tax year for which the estimated

Line 9 - Enter your 2011 tax liability as reported on line 54 of

payments were required, and such underpayment was due to

the IA1040, less 2011 refundable credits as reported on lines

reasonable cause and not to willful neglect.

62 through 66.

Farmers and Fishers: You are exempt from underpayment of

Exception: If your 2011 federal AGI exceeds $150,000

estimated tax penalty if (1) your gross income from farming

($75,000 for married filing separate federal returns) plus any

or fishing is at least two-thirds of your annual gross income,

bonus depreciation adjustment, you must use 110% of the

and (2) you filed IA 1040 and paid the tax on or before March

2011 Iowa tax less credits.

1, 2013, or (3) you paid the estimated tax in one payment on

Taxpayers may avoid underpayment penalty if their estimated

or before January 15, 2013.

payments for 2012, made on or before the prescribed dates for

If you meet this gross income test but did not file a return or

payment, plus Iowa tax withheld for 2012, are equal to the

pay the tax when due, use form IA 2210F, instead of this

lesser of: (1) 90 % of the tax shown on the 2012 return; or (2)

form, to determine whether you owe a penalty.

45-007b (09/07/12)

100% of the tax shown on the 2011 return if their 2011

1

1 2

2