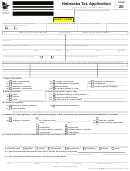

Read the attached Nebraska Licensing Requirements and complete the information

for all tax programs for which you need to be licensed.

If you need to report a liability for periods prior to the date of this application, enter the earliest date (month, day, year) for which you need a return.

13 SALES AND USE TAX (NO FEE)

Month/Day/Year

Sales Tax Permit — Enter the date of your first sale ..................................................................................................

a. Select a filing frequency based on your estimated annual state sales tax liability:

(1)

$3,000 or more (monthly)

(2)

$900 to $2,999 (quarterly)

(4)

Less than $900 (annually)

b. If you have more than one licensed location, your returns will be filed:

(1)

Separate for each location

(2)

Combined for all locations (monthly e-filing is required), file application

Form

11.

Month/Day/Year

Use Tax Permit — Enter the date of your first purchase ............................................................................................

a. If a sales tax permit has been applied for, do not check this box since use tax is to be reported on the sales tax return.

b. Select a filing frequency based on your estimated annual state use tax liability:

(1)

$3,000 or more (monthly)

(2)

$900 to $2,999 (quarterly)

(4)

Less than $900 (annually)

14 WITHHOLDING AND INCOME TAX (NO FEE)

Month/Day/Year

Income Tax Withholding — Enter the date of the first wages paid .............................................................................

a. Will your average Nebraska monthly withholding exceed $500? ............................. (1)

YES

NO

b. 1. Will your annual state income tax withholding be less than $500 per year? .....

YES

NO

2. Have you been allowed to file federal withholding returns annually? .................

YES

NO

If you answered YES to either of the questions in “b,” mark filing frequency preference ...... (2)

Quarterly

(4)

Annually

c. Withholding tax returns will be filed:

(1)

For each separate location

(2)

Consolidated for all locations

(3)

Consolidated by region or district

d. Will you have a payroll service prepare your returns?

YES (If YES, attach a

Power of Attorney, Form

33.)

NO

e. Additional business operations employing Nebraska residents (Attach additional sheet if necessary.)

Nebraska ID Number

Business Name

Location Address, City, State, Zip Code

Note for LLCs: LLCs that are required to file with Nebraska and file their federal income tax as a corporation or

(Enter Beginning Date)

Month/Day/Year

partnership, must check either “corporate” or “partnership” below.

Corporate Income Tax................................................................................................................................................

Are you an S Corporation? ......................................................................................... (3)

YES

NO

Partnership Income Tax .............................................................................................................................................

Fiduciary Income Tax .................................................................................................................................................

Financial Institution Tax (indicate type of institution) ..................................................................................................

(1)

Bank

(2)

Savings and Loan

(3)

Credit Union

(4)

Other (specify):

(Enter Date of

First Transaction)

15 MISCELLANEOUS TAX PROGRAMS

Month/Day/Year

Tire Fee Permit ..........................................................................................................................................................

Select a filing frequency based on your estimated annual taxable tire sales:

(1)

3,000 tires or more (monthly)

(2)

900 – 2,999 tires (quarterly)

(4)

Less than 900 tires (annually)

Lodging Tax Permit ....................................................................................................................................................

Select a filing frequency based on your estimated annual taxable sales:

(1)

$10,000 or more (monthly)

(4)

Less than $10,000 (annually)

Litter Fee License ......................................................................................................................................................

If you have more than one licensed location, you must file a combined litter fee return. File application

Form

11.

Severance and Conservation .....................................................................................................................................

Programs Requiring Fees:

Month/Day/Year

Wholesale Cigarette Dealer’s Permit — $500 Fee & $1,000 Bond Required (ENCLOSE PAYMENT & BOND) ...

License to Transport Unstamped Cigarettes — $10 Fee & $1,000 Bond Required (ENCLOSE PAYMENT & BOND)

Tobacco Products License — $25 Fee (ENCLOSE PAYMENT) ..............................................................................

You do not need this license if tobacco products (not including cigarettes) are purchased from a supplier who

has a Nebraska Tobacco Products License.

a. Foreign corporations must attach the “Acknowledgement of Filing” copy of the NE Certificate of Authority.

b. Noncorporate persons must designate a Nebraska resident agent.

16 Person to contact regarding this application

Authorized Contact Person (please print)

Title

Email Address

Telephone Number

Under penalties of law, I declare that I have examined this application, and to the best of my knowledge and belief, it is correct and complete.

sign

here

Signature of Owner, Partner, Member, Corporate Officer, or

Title

Date

Telephone Number

Person Authorized by Attached Power of Attorney

You may fax this form to 402-471-5927.

Mail this application to: NEBRASKA DEPARTMENT OF REVENUE, PO BOX 98903, LINCOLN, NE 68509-8903.

, 800-742-7474 (NE and IA), 402-471-5729

1

1 2

2