Instructions For Form Br - Business Return - City Of Middletown

ADVERTISEMENT

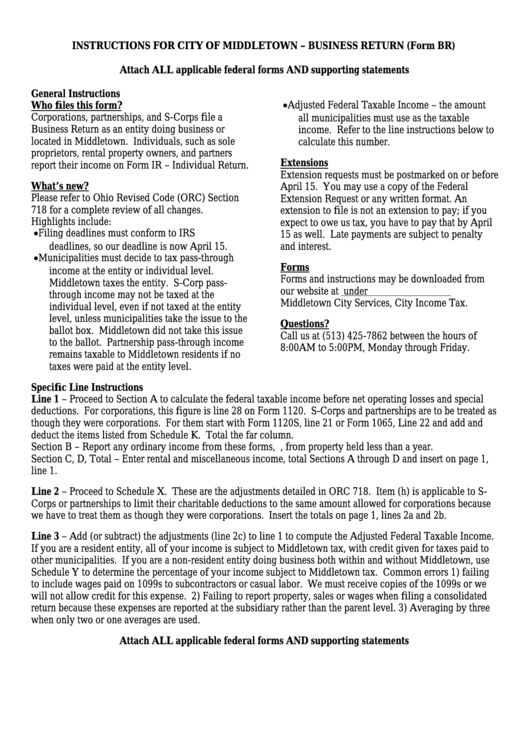

INSTRUCTIONS FOR CITY OF MIDDLETOWN – BUSINESS RETURN (Form BR)

Attach ALL applicable federal forms AND supporting statements

General Instructions

• Adjusted Federal Taxable Income – the amount

Who files this form?

Corporations, partnerships, and S-Corps file a

all municipalities must use as the taxable

Business Return as an entity doing business or

income. Refer to the line instructions below to

located in Middletown. Individuals, such as sole

calculate this number.

proprietors, rental property owners, and partners

Extensions

report their income on Form IR – Individual Return.

Extension requests must be postmarked on or before

What’s new?

April 15. You may use a copy of the Federal

Please refer to Ohio Revised Code (ORC) Section

Extension Request or any written format. An

718 for a complete review of all changes.

extension to file is not an extension to pay; if you

Highlights include:

expect to owe us tax, you have to pay that by April

• Filing deadlines must conform to IRS

15 as well. Late payments are subject to penalty

deadlines, so our deadline is now April 15.

and interest.

• Municipalities must decide to tax pass-through

Forms

income at the entity or individual level.

Forms and instructions may be downloaded from

Middletown taxes the entity. S-Corp pass-

our website at

under

through income may not be taxed at the

Middletown City Services, City Income Tax.

individual level, even if not taxed at the entity

level, unless municipalities take the issue to the

Questions?

ballot box. Middletown did not take this issue

Call us at (513) 425-7862 between the hours of

to the ballot. Partnership pass-through income

8:00AM to 5:00PM, Monday through Friday.

remains taxable to Middletown residents if no

taxes were paid at the entity level.

Specific Line Instructions

Line 1 – Proceed to Section A to calculate the federal taxable income before net operating losses and special

deductions. For corporations, this figure is line 28 on Form 1120. S-Corps and partnerships are to be treated as

though they were corporations. For them start with Form 1120S, line 21 or Form 1065, Line 22 and add and

deduct the items listed from Schedule K. Total the far column.

Section B – Report any ordinary income from these forms, e.g., from property held less than a year.

Section C, D, Total – Enter rental and miscellaneous income, total Sections A through D and insert on page 1,

line 1.

Line 2 – Proceed to Schedule X. These are the adjustments detailed in ORC 718. Item (h) is applicable to S-

Corps or partnerships to limit their charitable deductions to the same amount allowed for corporations because

we have to treat them as though they were corporations. Insert the totals on page 1, lines 2a and 2b.

Line 3 – Add (or subtract) the adjustments (line 2c) to line 1 to compute the Adjusted Federal Taxable Income.

If you are a resident entity, all of your income is subject to Middletown tax, with credit given for taxes paid to

other municipalities. If you are a non-resident entity doing business both within and without Middletown, use

Schedule Y to determine the percentage of your income subject to Middletown tax. Common errors 1) failing

to include wages paid on 1099s to subcontractors or casual labor. We must receive copies of the 1099s or we

will not allow credit for this expense. 2) Failing to report property, sales or wages when filing a consolidated

return because these expenses are reported at the subsidiary rather than the parent level. 3) Averaging by three

when only two or one averages are used.

Attach ALL applicable federal forms AND supporting statements

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1