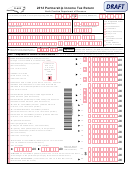

Form 58 - North Dakota Partnership Income Tax Booklet - 2012 Page 19

ADVERTISEMENT

North Dakota Office of State Tax Commissioner

2012 Form 58, page 4

Enter name of partnership

FEIN

Schedule K continued . . .

20a

20 a Angel fund investment credit

20b

b Angel fund investment credit purchased from another taxpayer in 2012

21

21 Housing incentive fund credit

Other items

Line 22 only applies to a professional service partnership

see instructions

22a

22 a Guaranteed payments from Federal Form 1065 (or 1065-B), Schedule K

22b

b Portion of line 22a paid for services performed everywhere by all partners

c Portion of line 22b paid to nonresident individual partners for services performed in

22c

North Dakota

Line 23 applies only to a multistate partnership

see instructions

23a

23 a Total allocable income from all sources (net of related expenses)

23b

b Portion of line 23a that is allocable to North Dakota

Line 24 applies to all partnerships

see instructions

24 For disposition(s) of I.R.C. Section 179 property, enter the North Dakota apportioned amounts

see instructions:

24a

a Gross sales price or amount realized

24b

b Cost or other basis plus expense of sale

24c

c Depreciation allowed or allowable (excluding I.R.C. Section 179 deduction)

24d

d I.R.C. Section 179 deduction related to property that was passed through to partners

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29