APPLICATION (cont’d.)

FOR NDR USE ONLY

Complete

Incomplete

B

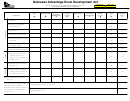

Explanation of how applicant intends to satisfy the chosen levels:

4B

D

Expected Benefits (see

Calculation

Tips)

4D

ATTACH a copy of completed Worksheet LM, provided in the Calculation Tips. The total

estimated credits cannot exceed $30,000.

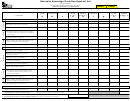

Investment

a

Expected investment increase

b

Expected investment credits

May not exceed $30,000

If item 5, 6, 7, or 8 is not available, indicate why the document is not available. If a reorganization occurred

since the previous tax year, provide copies of the documents for the previous entity(ies) and a written

explanation.

5

5 Attach copy of most recent financial statements (check each attached):

Audited financial report, including opinion letter

Unaudited financial statements

6 Enclose copy of most recent federal income tax filing. Include copy of first 4 pages, schedules supporting the

6

first 4 pages, Affiliations Schedule (Form 851), and a copy of each Shareholder’s Share of Income Credits,

Deductions, etc. (Schedule K-1). If the applicant is a sole proprietorship, provide a copy of the Profit

or Loss from Business (Schedule C) or the Profit or Loss from Farming (Schedule F).

7 Enclose copy of most recent Nebraska income tax return.

7

Are all entities listed in item 2 on page 1 included in one unitary NE tax return?

YES

NO

If No, explain why:

Explain any difference between taxable income per the federal return and the amount reported to

Nebraska:

8 Enclose copy of most recent Nebraska Reconciliation of Income Tax Withheld, Form W-3N.

8

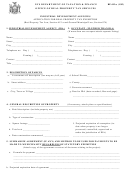

9 Nebraska sales and use tax number for each entity listed in item 2 on page 1 (if not licensed, attach a copy

9

of the Nebraska Tax Application, Form 20, and proof of date submitted):

Entity Name

Sales/Use Tax ID No.

1

2

3

4

(If you need more room, attach a schedule)

10 E-MAIL. If you allow the department to contact you by e-mail, you accept any risk of loss of confidentiality associated with this method of

communication.

AUTHORIZED SIGNATURE. This application must be signed by the owner/taxpayer, partner, member, corporate officer, or other individual

authorized to sign by a power of attorney on file with the department.

sign

here

Authorized Signature

Telephone Number

Please print your name

Title (See Instructions)

E-mail Address

Street or Other Mailing Address

City, State, Zip Code

1

1 2

2