Protective Claim For Refund - New Jersey Division Of Taxation

ADVERTISEMENT

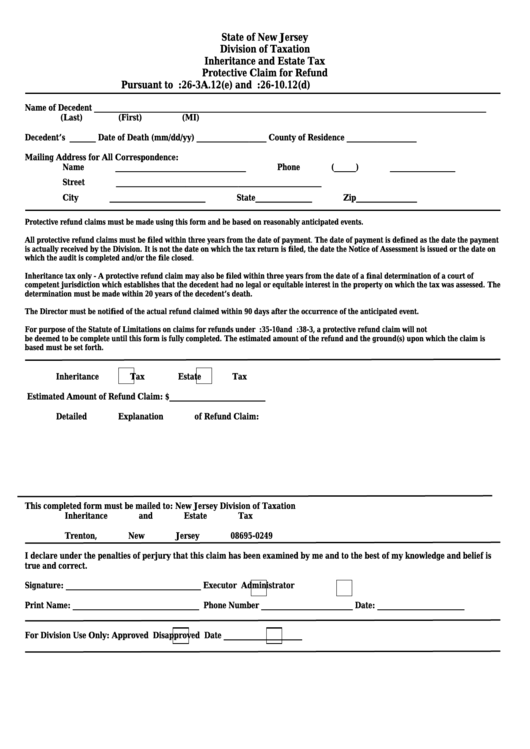

State of New Jersey

Division of Taxation

Inheritance and Estate Tax

Protective Claim for Refund

Pursuant to N.J.A.C. 18:26-3A.12(e) and N.J.A.C. 18:26-10.12(d)

Name of Decedent __________________________________________________________________________________________

(Last)

(First)

(MI)

Decedent’s S.S. No. ________________ Date of Death (mm/dd/yy) ________________ County of Residence ________________

Mailing Address for All Correspondence:

Name ______________________________ Phone (_____) _______________

Street _______________________________________________

City ______________________ State_____________ Zip______________

Protective refund claims must be made using this form and be based on reasonably anticipated events.

All protective refund claims must be filed within three years from the date of payment. The date of payment is defined as the date the payment

is actually received by the Division. It is not the date on which the tax return is filed, the date the Notice of Assessment is issued or the date on

which the audit is completed and/or the file closed.

Inheritance tax only - A protective refund claim may also be filed within three years from the date of a final determination of a court of

competent jurisdiction which establishes that the decedent had no legal or equitable interest in the property on which the tax was assessed. The

determination must be made within 20 years of the decedent’s death.

The Director must be notified of the actual refund claimed within 90 days after the occurrence of the anticipated event.

For purpose of the Statute of Limitations on claims for refunds under N.J.S.A. 54:35-10 and N.J.S.A. 54:38-3, a protective refund claim will not

be deemed to be complete until this form is fully completed. The estimated amount of the refund and the ground(s) upon which the claim is

based must be set forth.

Inheritance Tax

Estate Tax

Estimated Amount of Refund Claim:

$______________________

Detailed Explanation of Refund Claim:

This completed form must be mailed to: New Jersey Division of Taxation

Inheritance and Estate Tax

P.O. Box 249

Trenton, New Jersey 08695-0249

I declare under the penalties of perjury that this claim has been examined by me and to the best of my knowledge and belief is

true and correct.

Signature: _______________________________ Executor

Administrator

Print Name: _____________________________ Phone Number _____________________ Date: ____________________

For Division Use Only: Approved

Disapproved

Date __________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2