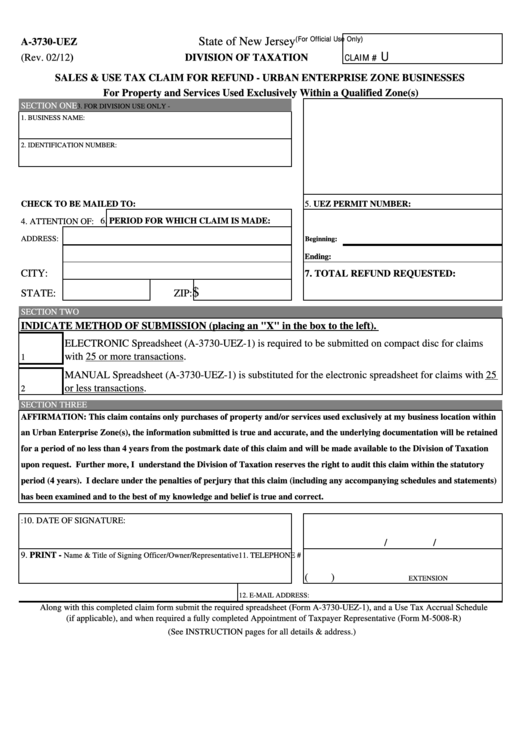

(For Official Use Only)

State of New Jersey

A-3730-UEZ

U

CLAIM #

(Rev. 02/12)

DIVISION OF TAXATION

SALES & USE TAX CLAIM FOR REFUND - URBAN ENTERPRISE ZONE BUSINESSES

For Property and Services Used Exclusively Within a Qualified Zone(s)

SECTION ONE

3. FOR DIVISION USE ONLY -

1. BUSINESS NAME:

2. IDENTIFICATION NUMBER:

CHECK TO BE MAILED TO:

5. UEZ PERMIT NUMBER:

6. PERIOD FOR WHICH CLAIM IS MADE:

4. ATTENTION OF:

ADDRESS:

Beginning:

Ending:

CITY:

7. TOTAL REFUND REQUESTED:

$

STATE:

ZIP:

SECTION TWO

INDICATE METHOD OF SUBMISSION (placing an "X" in the box to the left).

ELECTRONIC Spreadsheet (A-3730-UEZ-1) is required to be submitted on compact disc for claims

with 25 or more transactions.

1

MANUAL Spreadsheet (A-3730-UEZ-1) is substituted for the electronic spreadsheet for claims with 25

or less transactions.

2

SECTION THREE

AFFIRMATION: This claim contains only purchases of property and/or services used exclusively at my business location within

an Urban Enterprise Zone(s), the information submitted is true and accurate, and the underlying documentation will be retained

for a period of no less than 4 years from the postmark date of this claim and will be made available to the Division of Taxation

upon request. Further more, I understand the Division of Taxation reserves the right to audit this claim within the statutory

period (4 years). I declare under the penalties of perjury that this claim (including any accompanying schedules and statements)

has been examined and to the best of my knowledge and belief is true and correct.

10. DATE OF SIGNATURE:

8.SIGNATURE OF AUTHORIZED INDIVIDUAL SUBMITTING CLAIM:

/

/

9. PRINT -

Name & Title of Signing Officer/Owner/Representative

11. TELEPHONE #

(

)

EXTENSION

12. E-MAIL ADDRESS:

Along with this completed claim form submit the required spreadsheet (Form A-3730-UEZ-1), and a Use Tax Accrual Schedule

(if applicable), and when required a fully completed Appointment of Taxpayer Representative (Form M-5008-R)

(See INSTRUCTION pages for all details & address.)

1

1 2

2