Form Ct-500 - Corporation Tax Credit Deferral - 2012 Page 2

ADVERTISEMENT

Page 2 of 6 CT-500 (2012)

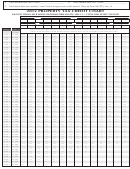

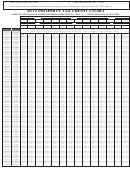

Schedule B – Refundable credits subject to deferral

A

B

C

D

E

Credit

Amount subject

Amount of credit allowed

Amount of credit

Amount of credit

to deferral

to be used or refunded

deferred

applied against

the tax

(column B × line 4)

(column B - column C)

(see instructions)

Special additional mortgage recording

tax credit for residential mortgages only

.......................

(from Form CT-43, line 12)

ITC for the financial services industry

for certain qualified businesses only

......................

(from Form CT-44, line 31)

ITC, including retail enterprises and

historic barns credits for new businesses

only

................

(from Form CT-46, line 18a)

Clean heating fuel credit

(from

..............................

Form CT-241, line 7)

Conservation easement tax credit

......................

(from Form CT-242, line 4)

Biofuel production credit

(from

..............................

Form CT-243, line 5)

Empire State commercial production

credit

..........

(from Form CT-246, line 15)

EZ-ITC for qualified or new businesses

only

............

(from Form CT-603, line 20a)

EZ-EIC for certain qualified businesses

only

.............

(from Form CT-603, line 25a)

QEZE credit for real property taxes

(from Form CT-604-CP, line 1, or

.......................

CT-606, line 21 or line 55)

EZ-ITC for the financial services

industry for certain qualified businesses

only

(from Form CT-605, line 32) .................

EZ-EIC for the financial services

industry for certain qualified businesses

only

..............

(from Form CT-605, line 39)

Brownfield redevelopment tax credit

....................

(from Form CT-611, line 18)

Brownfield redevelopment tax credit

..................

(from Form CT-611.1, line 18)

Remediated brownfield credit for real

property taxes

...

(from Form CT-612, line 11)

Environmental remediation insurance

credit

...........

(from Form CT-613, line 7 )

Security officer training tax credit

(from

..............................

Form CT-631, line 3)

QETC employment credit

(from

..........................

Form DTF-621, line 27)

EZ wage tax credit

(refundable portion

...................

from Form CT-601, line 36a)

2 Totals of Schedule B

(add

2

all amounts in each column)

534002120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6