Form Ct-222.1 - Election To Use Different Annualization Periods For Corporate Estimated Tax - 2012

ADVERTISEMENT

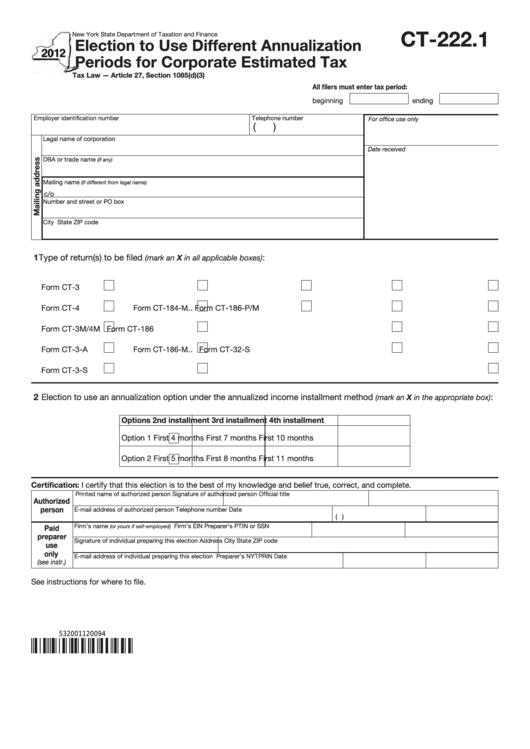

CT-222.1

New York State Department of Taxation and Finance

Election to Use Different Annualization

Periods for Corporate Estimated Tax

Tax Law — Article 27, Section 1085(d)(3)

All filers must enter tax period:

beginning

ending

Employer identification number

Telephone number

For office use only

(

)

Legal name of corporation

Date received

DBA or trade name

(if any)

Mailing name

(if different from legal name)

c/o

Number and street or PO box

City

State

ZIP code

1 Type of return(s) to be filed

:

(mark an X in all applicable boxes)

Form CT-3 ..........

Form CT-184 ......

Form CT-186-P ........

Form CT-32 ........

Form CT-33 ..........

Form CT-4 ..........

Form CT-184-M ...

Form CT-186-P/M ....

Form CT-32-M ...

Form CT-33-M .....

Form CT-3M/4M

Form CT-186 ......

Form CT-32-A ....

Form CT-33-A ......

Form CT-3-A ......

Form CT-186-M ...

Form CT-32-S ....

Form CT-33-C ......

Form CT-3-S ......

Form CT-186-E ...

Form CT-33-NL ....

2 Election to use an annualization option under the annualized income installment method

:

(mark an X in the appropriate box)

Options

2nd installment

3rd installment

4th installment

Option 1

First 4 months

First 7 months

First 10 months

Option 2

First 5 months

First 8 months

First 11 months

Certification: I certify that this election is to the best of my knowledge and belief true, correct, and complete.

Printed name of authorized person

Signature of authorized person

Official title

Authorized

person

E-mail address of authorized person

Telephone number

Date

(

)

Firm’s name

Firm’s EIN

Preparer’s PTIN or SSN

Paid

(or yours if self-employed)

preparer

Signature of individual preparing this election

Address

City

State

ZIP code

use

only

E-mail address of individual preparing this election

Preparer’s NYTPRIN

Date

(see instr.)

See instructions for where to file.

532001120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2