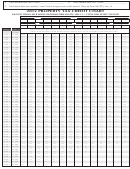

IT-500 (2012) (back)

Schedule B – Refundable credits subject to deferral

B

C

D

A

Amount of credit

Amount of credit allowed

Amount of credit

Credit name

credit form number and line number

subject to deferral

to be used or refunded

deferred

(column B – column C)

×

(column B

line 6)

Biofuel production credit

.

.

.

(Form IT-243, line 13)

00

00

00

Brownfield credits

Brownfield redevelopment tax credit

(Form IT-611, line 28)

.

.

.

00

00

00

Brownfield redevelopment tax credit

.

.

.

(Form IT-611.1, line 28)

00

00

00

Remediated brownfield credit for real

property taxes

(Form IT-612, line 18)

.

.

.

00

00

00

Environmental remediation insurance

credit

.

.

.

(Form IT-613, line 11)

00

00

00

Clean heating fuel credit

.

.

.

(Form IT-241, line 10)

00

00

00

Conservation easement credit

.

.

.

(Form IT-242, line 10)

00

00

00

Empire State commercial production credit

.

.

.

(Form IT-246, line 15)

00

00

00

EZ investment tax credit (ITC)

(including EZ employment incentive credit)

.

.

.

(Form IT-603, line 29)

00

00

00

EZ wage tax credit

.

.

.

(Form IT-601, line 40)

00

00

00

FSI EZ ITC

(including FSI EZ employment

.

.

.

incentive credit) (Form IT-605, line 34)

00

00

00

FSI ITC

(including FSI employment incentive

.

.

.

credit) (Form IT-252, line 35)

00

00

00

Historic barn rehabilitation credit

(see Investment credit)

Historic homeownership rehabilitation credit

.

.

.

(Form IT-237, line 8)

00

00

00

Investment credit

(including employment

incentive credit, retail enterprise credit, and

historic barn rehabilitation credit)

.

.

.

(Form IT-212, line 37)

00

00

00

QETC employment credit

.

.

.

(Form DTF-621, line 27)

00

00

00

QEZE credit for real property taxes

.

.

.

(Form IT-606, line 24 or line 52)

00

00

00

Security officer training credit

.

.

.

(Form IT-631, line 5)

00

00

00

Special additional mortgage recording tax

.

.

.

credit

00

00

00

(Form IT-256, line 18)

.

.

.

00

00

00

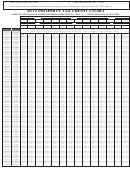

3 Column totals

4 Refundable credits subject to deferral

.

................................

4

(enter the amount from line 3, column B)

00

5 Total credits subject to deferral

.

........................................................................

5

(add lines 2 and 4)

00

–

If line 5 is 2,000,000 or less, Stop! You are not subject to a credit deferral.

–

.

If line 5 is more than 2,000,000, complete line 6

6 Divide 2,000,000 by line 5

...................................................................

6

(carry the result to six decimal places)

500002120094

1

1 2

2