Corporation Franchise Tax Report - 2004

ADVERTISEMENT

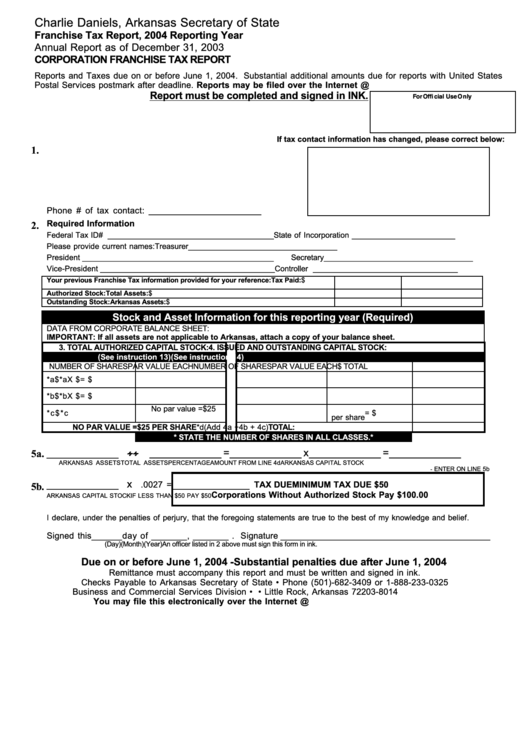

Charlie Daniels, Arkansas Secretary of State

Franchise Tax Report, 2004 Reporting Year

Annual Report as of December 31, 2003

CORPORATION FRANCHISE TAX REPORT

Reports and Taxes due on or before June 1, 2004. Substantial additional amounts due for reports with United States

Postal Services postmark after deadline. Reports may be filed over the Internet @

Report must be completed and signed in INK.

For Official Use Only

If tax contact information has changed, please correct below:

1.

Phone # of tax contact: _______________________

2.

Required Information

Federal Tax ID# _______________________________________

State of Incorporation ________________________

Please provide current names:

Treasurer ___________________________________

President _____________________________________________

Secretary___________________________________

Vice-President _________________________________________

Controller __________________________________

Your previous Franchise Tax information provided for your reference:

Tax Paid:

$

Authorized Stock:

Total Assets:

$

Outstanding Stock:

Arkansas Assets:

$

Stock and Asset Information for this reporting year (Required)

DATA FROM CORPORATE BALANCE SHEET:

IMPORTANT: If all assets are not applicable to Arkansas, attach a copy of your balance sheet.

3. TOTAL AUTHORIZED CAPITAL STOCK:

4. ISSUED AND OUTSTANDING CAPITAL STOCK:

(See instruction 13)

(See instruction 14)

NUMBER OF SHARES

PAR VALUE EACH

NUMBER OF SHARES

PAR VALUE EACH

$ TOTAL

*a

$

*a

X $

= $

*b

$

*b

X $

= $

No par value =$25

* c

$

* c

= $

per share

NO PAR VALUE =$25 PER SHARE

*d

(Add 4a +4b + 4c)

TOTAL:

* STATE THE NUMBER OF SHARES IN ALL CLASSES.*

____________ ÷ ÷ ÷ ÷ ____________ = ____________ x

5a.

____________ = ____________

ARKANSAS ASSETS

TOTAL ASSETS

PERCENTAGE

AMOUNT FROM LINE 4d

ARKANSAS CAPITAL STOCK

-

ENTER ON LINE 5b

5b.

____________ x

_____________

.0027 =

TAX DUE

MINIMUM TAX DUE $50

Corporations Without Authorized Stock Pay $100.00

ARKANSAS CAPITAL STOCK

IF LESS THAN $50 PAY $50

I declare, under the penalties of perjury, that the foregoing statements are true to the best of my knowledge and belief.

Signed this ______day of _______, _______ . Signature _________________________________________

(Day)

(Month)

(Year)

An officer listed in 2 above must sign this form in ink.

Due on or before June 1, 2004 -Substantial penalties due after June 1, 2004

Remittance must accompany this report and must be written and signed in ink.

Checks Payable to Arkansas Secretary of State • Phone (501)-682-3409 or 1-888-233-0325

Business and Commercial Services Division • P.O. Box 8014 • Little Rock, Arkansas 72203-8014

You may file this electronically over the Internet @

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1