Ohio Corporation Franchise Tax Report Instructions For Financial Institutions - 2004

ADVERTISEMENT

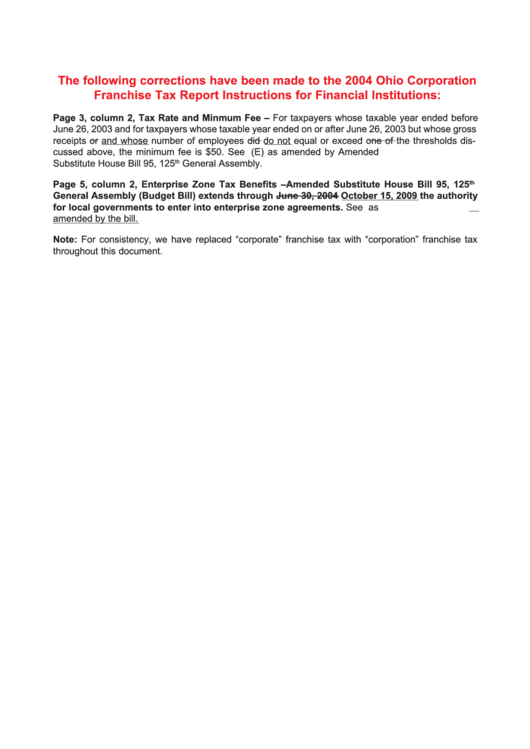

The following corrections have been made to the 2004 Ohio Corporation

Franchise Tax Report Instructions for Financial Institutions:

Page 3, column 2, Tax Rate and Minmum Fee – For taxpayers whose taxable year ended before

June 26, 2003 and for taxpayers whose taxable year ended on or after June 26, 2003 but whose gross

receipts or and whose number of employees did do not equal or exceed one of the thresholds dis-

cussed above, the minimum fee is $50. See O.R.C. section 5733.06(E) as amended by Amended

Substitute House Bill 95, 125

General Assembly.

th

Page 5, column 2, Enterprise Zone Tax Benefits – Amended Substitute House Bill 95, 125

th

General Assembly (Budget Bill) extends through June 30, 2004 October 15, 2009 the authority

for local governments to enter into enterprise zone agreements. See O.R.C. section 5709.62 as

amended by the bill.

Note: For consistency, we have replaced “corporate” franchise tax with “corporation” franchise tax

throughout this document.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23