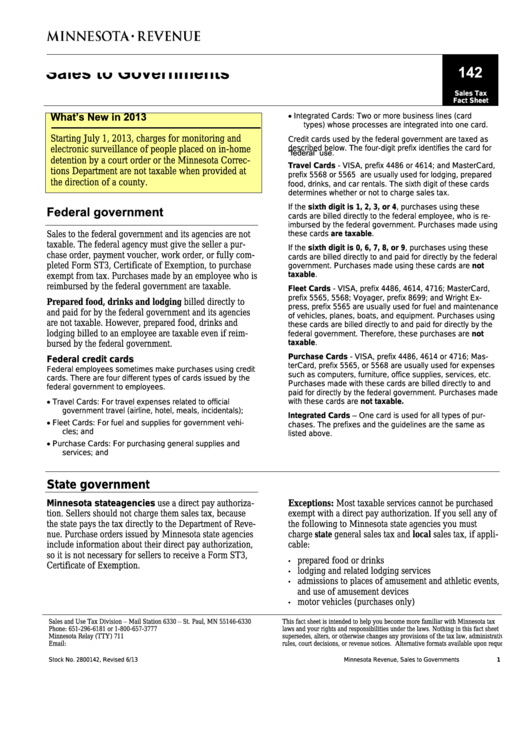

Sales Tax Fact Sheet - Sales To Governments - Minnesota Department Of Revenue

ADVERTISEMENT

142

Sales to Governments

Sales Tax

Fact Sheet

Integrated Cards: Two or more business lines (card

What’s New in 2013

types) whose processes are integrated into one card.

Starting July 1, 2013, charges for monitoring and

Credit cards used by the federal government are taxed as

described below. The four-digit prefix identifies the card for

electronic surveillance of people placed on in-home

“federal” use.

detention by a court order or the Minnesota Correc-

Travel Cards - VISA, prefix 4486 or 4614; and MasterCard,

tions Department are not taxable when provided at

prefix 5568 or 5565 are usually used for lodging, prepared

the direction of a county.

food, drinks, and car rentals. The sixth digit of these cards

determines whether or not to charge sales tax.

If the sixth digit is 1, 2, 3, or 4, purchases using these

Federal government

cards are billed directly to the federal employee, who is re-

imbursed by the federal government. Purchases made using

these cards are taxable.

Sales to the federal government and its agencies are not

taxable. The federal agency must give the seller a pur-

If the sixth digit is 0, 6, 7, 8, or 9, purchases using these

chase order, payment voucher, work order, or fully com-

cards are billed directly to and paid for directly by the federal

pleted Form ST3, Certificate of Exemption, to purchase

government. Purchases made using these cards are not

taxable.

exempt from tax. Purchases made by an employee who is

reimbursed by the federal government are taxable.

Fleet Cards - VISA, prefix 4486, 4614, 4716; MasterCard,

prefix 5565, 5568; Voyager, prefix 8699; and Wright Ex-

Prepared food, drinks and lodging billed directly to

press, prefix 5565 are usually used for fuel and maintenance

and paid for by the federal government and its agencies

of vehicles, planes, boats, and equipment. Purchases using

are not taxable. However, prepared food, drinks and

these cards are billed directly to and paid for directly by the

lodging billed to an employee are taxable even if reim-

federal government. Therefore, these purchases are not

taxable.

bursed by the federal government.

Purchase Cards - VISA, prefix 4486, 4614 or 4716; Mas-

Federal credit cards

terCard, prefix 5565, or 5568 are usually used for expenses

Federal employees sometimes make purchases using credit

such as computers, furniture, office supplies, services, etc.

cards. There are four different types of cards issued by the

Purchases made with these cards are billed directly to and

federal government to employees.

paid for directly by the federal government. Purchases made

Travel Cards: For travel expenses related to official

with these cards are not taxable.

government travel (airline, hotel, meals, incidentals);

Integrated Cards – One card is used for all types of pur-

Fleet Cards: For fuel and supplies for government vehi-

chases. The prefixes and the guidelines are the same as

cles; and

listed above.

Purchase Cards: For purchasing general supplies and

services; and

State government

Minnesota state agencies use a direct pay authoriza-

Exceptions: Most taxable services cannot be purchased

tion. Sellers should not charge them sales tax, because

exempt with a direct pay authorization. If you sell any of

the state pays the tax directly to the Department of Reve-

the following to Minnesota state agencies you must

nue. Purchase orders issued by Minnesota state agencies

charge state general sales tax and local sales tax, if appli-

include information about their direct pay authorization,

cable:

so it is not necessary for sellers to receive a Form ST3,

•

prepared food or drinks

Certificate of Exemption.

•

lodging and related lodging services

•

admissions to places of amusement and athletic events,

and use of amusement devices

motor vehicles (purchases only)

•

Sales and Use Tax Division – Mail Station 6330 – St. Paul, MN 55146-6330

This fact sheet is intended to help you become more familiar with Minnesota tax

Phone: 651-296-6181 or 1-800-657-3777

laws and your rights and responsibilities under the laws. Nothing in this fact sheet

Minnesota Relay (TTY) 711

supersedes, alters, or otherwise changes any provisions of the tax law, administrative

Email: salesuse.tax@state.mn.us

rules, court decisions, or revenue notices. Alternative formats available upon request.

Stock No. 2800142, Revised 6/13

Minnesota Revenue, Sales to Governments

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4