Form Ct-601.1 - Claim For Zea Wage Tax Credit - 2011

ADVERTISEMENT

Staple forms here

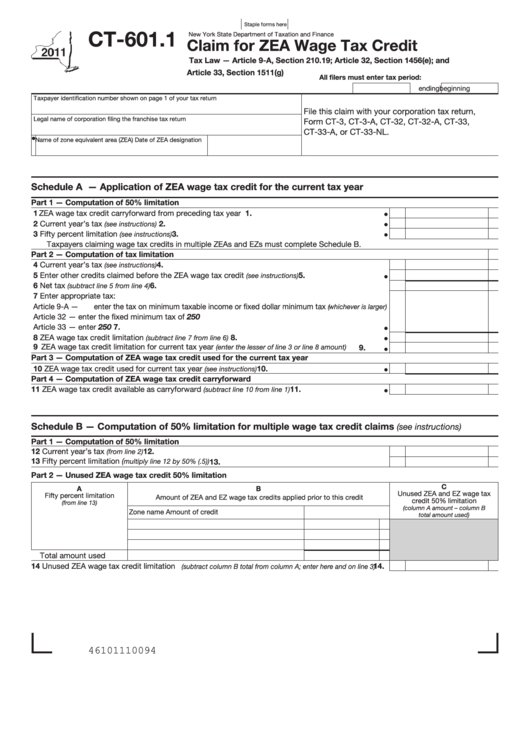

CT-601.1

New York State Department of Taxation and Finance

Claim for ZEA Wage Tax Credit

Tax Law — Article 9-A, Section 210.19; Article 32, Section 1456(e); and

Article 33, Section 1511(g)

All filers must enter tax period:

beginning

ending

Taxpayer identification number shown on page 1 of your tax return

File this claim with your corporation tax return,

Legal name of corporation filing the franchise tax return

Form CT-3, CT-3-A, CT-32, CT-32-A, CT-33,

CT-33-A, or CT-33-NL.

Name of zone equivalent area (ZEA)

Date of ZEA designation

Schedule A — Application of ZEA wage tax credit for the current tax year

Part 1 — Computation of 50% limitation

1 ZEA wage tax credit carryforward from preceding tax year .............................................................

1.

2 Current year’s tax

.....................................................................................................

2.

(see instructions)

3 Fifty percent limitation

3.

.............................................................................................

(see instructions)

Taxpayers claiming wage tax credits in multiple ZEAs and EZs must complete Schedule B.

Part 2 — Computation of tax limitation

4 Current year’s tax

.......................................................................................................

4.

(see instructions)

5 Enter other credits claimed before the ZEA wage tax credit

...................................

5.

(see instructions)

6 Net tax

..........................................................................................................

6.

(subtract line 5 from line 4)

7 Enter appropriate tax:

Article 9-A — enter the tax on minimum taxable income or fixed dollar minimum tax

(whichever is larger)

Article 32 — enter the fixed minimum tax of 250

Article 33 — enter 250 .....................................................................................................................

7.

8 ZEA wage tax credit limitation

...................................................................

8.

(subtract line 7 from line 6)

9 ZEA wage tax credit limitation for current tax year

..............

(enter the lesser of line 3 or line 8 amount)

9.

Part 3 — Computation of ZEA wage tax credit used for the current tax year

10 ZEA wage tax credit used for current tax year

10.

........................................................

(see instructions)

Part 4 — Computation of ZEA wage tax credit carryforward

11 ZEA wage tax credit available as carryforward

........................................

11.

(subtract line 10 from line 1)

Schedule B — Computation of 50% limitation for multiple wage tax credit claims

(see instructions)

Part 1 — Computation of 50% limitation

12 Current year’s tax

.............................................................................................................. 12.

(from line 2)

13 Fifty percent limitation (

............................................................................... 13.

multiply line 12 by 50% (.5))

Part 2 — Unused ZEA wage tax credit 50% limitation

C

A

B

Unused ZEA and EZ wage tax

Fifty percent limitation

Amount of ZEA and EZ wage tax credits applied prior to this credit

credit 50% limitation

(from line 13)

(column A amount – column B

Zone name

Amount of credit

total amount used)

Total amount used

14 Unused ZEA wage tax credit limitation

.... 14.

(subtract column B total from column A; enter here and on line 3)

46101110094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2