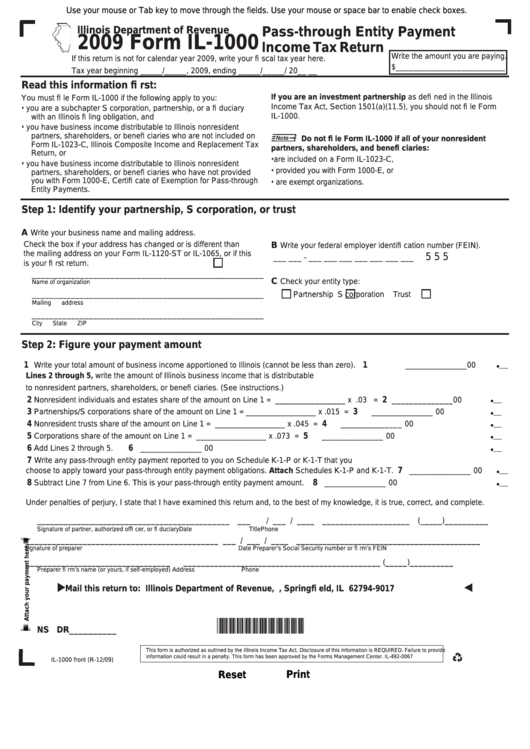

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

lllinois Department of Revenue

Pass-through Entity Payment

2009 Form IL-1000

Income Tax Return

Write the amount you are paying.

If this return is not for calendar year 2009, write your fi scal tax year here.

$_________________________

Tax year beginning _____/_____, 2009, ending _____/_____/ 20__ __

Read this information fi rst:

If you are an investment partnership as defi ned in the Illinois

You must fi le Form IL-1000 if the following apply to you:

Income Tax Act, Section 1501(a)(11.5), you should not fi le Form

• you are a subchapter S corporation, partnership, or a fi duciary

IL-1000.

with an Illinois fi ling obligation, and

• you have business income distributable to Illinois nonresident

partners, shareholders, or benefi ciaries who are not included on

Do not fi le Form IL-1000 if all of your nonresident

Form IL-1023-C, Illinois Composite Income and Replacement Tax

partners, shareholders, and benefi ciaries:

Return, or

• are included on a Form IL-1023-C,

• you have business income distributable to Illinois nonresident

• provided you with Form 1000-E, or

partners, shareholders, or benefi ciaries who have not provided

you with Form 1000-E, Certifi cate of Exemption for Pass-through

• are exempt organizations.

Entity Payments.

Step 1: Identify your partnership, S corporation, or trust

A

Write your business name and mailing address.

Check the box if your address has changed or is different than

B

Write your federal employer identifi cation number (FEIN).

the mailing address on your Form IL-1120-ST or IL-1065, or if this

5 5 5

___ ___ - ___ ___ ___ ___ ___ ___ ___

is your fi rst return.

_____________________________________________________

C

Check your entity type:

Name of organization

_____________________________________________________

Partnership

S corporation

Trust

Mailing address

_____________________________________________________

City

State

ZIP

Step 2: Figure your payment amount

1

1

Write your total amount of business income apportioned to Illinois (cannot be less than zero).

______________ 00

Lines 2 through 5, write the amount of Illinois business income that is distributable

to nonresident partners, shareholders, or benefi ciaries. (See instructions.)

2

2

Nonresident individuals and estates share of the amount on Line 1 = ________________ x .03 =

______________ 00

3

3

Partnerships/S corporations share of the amount on Line 1

= ________________ x .015 =

______________ 00

4

4

Nonresident trusts share of the amount on Line 1

= ________________ x .045 =

______________ 00

5

5

Corporations share of the amount on Line 1

= ________________ x .073 =

______________ 00

6

6

Add Lines 2 through 5.

______________ 00

7

Write any pass-through entity payment reported to you on Schedule K-1-P or K-1-T that you

7

choose to apply toward your pass-through entity payment obligations. Attach Schedules K-1-P and K-1-T.

______________ 00

8

8

Subtract Line 7 from Line 6. This is your pass-through entity payment amount.

______________ 00

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

____________________________________________

___ / ___ / ____ ____________________

(_____)__________

Signature of partner, authorized offi cer, or fi duciary

Date

Title

Phone

____________________________________________

___ / ___ / ____ __________________________________________

Signature of preparer

Date

Preparer’s Social Security number or fi rm’s FEIN

_________________________________

_____________________________________________

(_____)__________

Preparer fi rm’s name (or yours, if self-employed)

Address

Phone

Mail this return to: Illinois Department of Revenue, P.O. Box 19017, Springfi eld, IL 62794-9017

*959801110*

NS

DR__________

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to provide

information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-0067

IL-1000 front (R-12/09)

Reset

Print

1

1