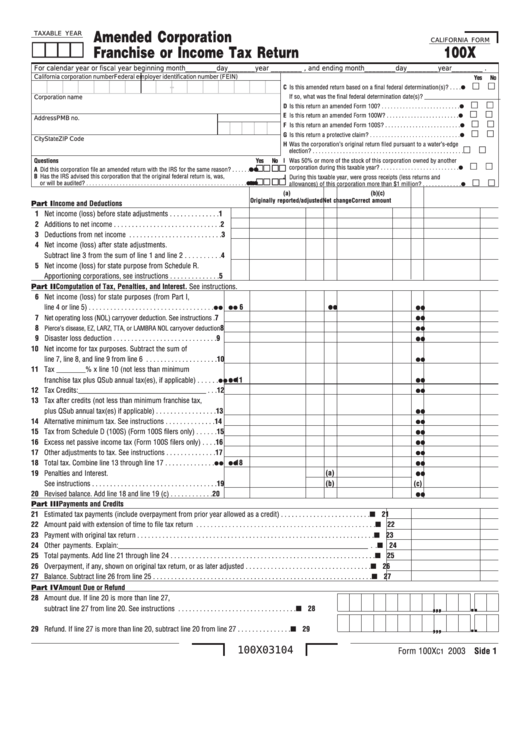

California Form 100x - Amended Corporation Franchise Or Income Tax Return - 2003

ADVERTISEMENT

Amended Corporation

TAXABLE YEAR

CALIFORNIA FORM

100X

Franchise or Income Tax Return

For calendar year or fiscal year beginning month ________ day _______ year ________ , and ending month ________ day ________ year ________ .

California corporation number

Federal employer identification number (FEIN)

Yes

No

-

¼

C Is this amended return based on a final federal determination(s)? . . . .

If so, what was the final federal determination date(s)? _________________________

Corporation name

¼

D Is this return an amended Form 100? . . . . . . . . . . . . . . . . . . . . . . . . . .

¼

E Is this return an amended Form 100W? . . . . . . . . . . . . . . . . . . . . . . . .

Address

PMB no.

¼

F Is this return an amended Form 100S? . . . . . . . . . . . . . . . . . . . . . . . . .

¼

G Is this return a protective claim? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

City

State

ZIP Code

H Was the corporation’s original return filed pursuant to a water’s-edge

election? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Questions

Yes

No

I Was 50% or more of the stock of this corporation owned by another

¼

¼ ¼ ¼ ¼ ¼

corporation during this taxable year? . . . . . . . . . . . . . . . . . . . . . . . . . .

A Did this corporation file an amended return with the IRS for the same reason? . . . . . .

B Has the IRS advised this corporation that the original federal return is, was,

J During this taxable year, were gross receipts (less returns and

¼ ¼ ¼ ¼ ¼

¼

or will be audited? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

allowances) of this corporation more than $1 million? . . . . . . . . . . . . .

(a)

(b)

(c)

Originally reported/adjusted

Net change

Correct amount

Income and Deductions

Part I

1 Net income (loss) before state adjustments . . . . . . . . . . . . . .

1

2 Additions to net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Deductions from net income . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Net income (loss) after state adjustments.

Subtract line 3 from the sum of line 1 and line 2 . . . . . . . . . .

4

5 Net income (loss) for state purpose from Schedule R.

Apportioning corporations, see instructions . . . . . . . . . . . . . .

5

Part II Computation of Tax, Penalties, and Interest. See instructions.

6 Net income (loss) for state purposes (from Part I,

¼ ¼ ¼ ¼ ¼

¼ ¼ ¼ ¼ ¼

¼ ¼ ¼ ¼ ¼

line 4 or line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

¼ ¼ ¼ ¼ ¼

7

7

Net operating loss (NOL) carryover deduction. See instructions .

¼ ¼ ¼ ¼ ¼

8

8

Pierce’s disease, EZ, LARZ, TTA, or LAMBRA NOL carryover deduction

¼ ¼ ¼ ¼ ¼

9 Disaster loss deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Net income for tax purposes. Subtract the sum of

¼ ¼ ¼ ¼ ¼

line 7, line 8, and line 9 from line 6 . . . . . . . . . . . . . . . . . . . .

10

11 Tax ________% x line 10 (not less than minimum

¼ ¼ ¼ ¼ ¼

¼ ¼ ¼ ¼ ¼

franchise tax plus QSub annual tax(es), if applicable) . . . . . .

11

¼ ¼ ¼ ¼ ¼

12 Tax Credits:___________________________________ . . .

12

13 Tax after credits (not less than minimum franchise tax,

¼ ¼ ¼ ¼ ¼

plus QSub annual tax(es) if applicable) . . . . . . . . . . . . . . . . .

13

¼ ¼ ¼ ¼ ¼

14 Alternative minimum tax. See instructions . . . . . . . . . . . . . .

14

¼ ¼ ¼ ¼ ¼

15 Tax from Schedule D (100S) (Form 100S filers only) . . . . . .

15

¼ ¼ ¼ ¼ ¼

16 Excess net passive income tax (Form 100S filers only) . . . .

16

¼ ¼ ¼ ¼ ¼

17 Other adjustments to tax. See instructions . . . . . . . . . . . . . .

17

¼ ¼ ¼ ¼ ¼

¼ ¼ ¼ ¼ ¼

18 Total tax. Combine line 13 through line 17 . . . . . . . . . . . . . .

18

¼ ¼ ¼ ¼ ¼

(a)

19 Penalties and Interest.

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

(b)

(c)

¼ ¼ ¼ ¼ ¼

20 Revised balance. Add line 18 and line 19 (c) . . . . . . . . . . . .

20

Part III Payments and Credits

21 Estimated tax payments (include overpayment from prior year allowed as a credit) . . . . . . . . . . . . . . . . . . . . . . . . .

21

22 Amount paid with extension of time to file tax return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

23 Payment with original tax return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

24 Other payments. Explain:____________________________________________________________________ . .

24

25 Total payments. Add line 21 through line 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

26 Overpayment, if any, shown on original tax return, or as later adjusted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

27 Balance. Subtract line 26 from line 25 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

Part IV Amount Due or Refund

28 Amount due. If line 20 is more than line 27,

. . . . .

,

,

,

subtract line 27 from line 20. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

. . . . .

,

,

,

29 Refund. If line 27 is more than line 20, subtract line 20 from line 27 . . . . . . . . . . . . . . .

29

100X03104

Form 100X

2003 Side 1

C1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2