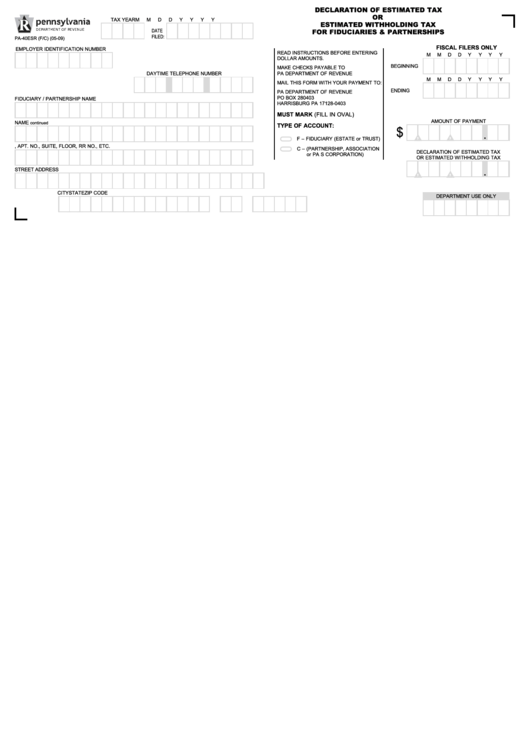

Form Pa-40esr - Declaration Of Estimated Tax Or Estimated Withholding Tax For Fiduciaries & Partnerships

ADVERTISEMENT

DECLARATION OF ESTIMATED TAX

OR

TAX YEAR

M

M

D

D

Y

Y

Y

Y

ESTIMATED WITHHOLDING TAX

DATE

FOR FIDUCIARIES & PARTNERSHIPS

FILED:

PA-40ESR (F/C) (05-09)

FISCAL FILERS ONLY

EMPLOYER IDENTIFICATION NUMBER

READ INSTRUCTIONS BEFORE ENTERING

M

M

D

D

Y

Y

Y

Y

DOLLAR AMOUNTS.

BEGINNING

MAKE CHECKS PAYABLE TO

DAYTIME TELEPHONE NUMBER

PA DEPARTMENT OF REVENUE

M

M

D

D

Y

Y

Y

Y

MAIL THIS FORM WITH YOUR PAYMENT TO:

ENDING

PA DEPARTMENT OF REVENUE

PO BOX 280403

FIDUCIARY / PARTNERSHIP NAME

HARRISBURG PA 17128-0403

MUST MARK (FILL IN OVAL)

AMOUNT OF PAYMENT

NAME

continued

TYPE OF ACCOUNT:

$

.

,

,

L

L

F – FIDUCIARY (ESTATE or TRUST)

P.O. BOX, APT. NO., SUITE, FLOOR, RR NO., ETC.

C – (PARTNERSHIP, ASSOCIATION

DECLARATION OF ESTIMATED TAX

or PA S CORPORATION)

OR ESTIMATED WITHHOLDING TAX

.

STREET ADDRESS

,

,

L

L

CITY

STATE

ZIP CODE

DEPARTMENT USE ONLY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2