A taxpayer may not claim this credit or carry it forward into a year that the taxpayer has claimed the targeted

business tax credit or the enterprise zone credit.

Utah Code §59-7-610 and

§59-7-

1007 allows a nonrefundable tax credit against individual income tax, corporate

franchise or income tax, or fiduciary tax if operating in a recycling market development zone, as defined in Utah Code

Section 63M- -1102. The credit

1

is equal to

: (a) 5

%

of the purchase price paid during the taxable year for machinery and

equipment used directly in commercial composting, or manufacturing facilities or plant units that manufacture recycled

items or reduce or reuse postconsumer waste material; and (b) 20

%

of

the

net expenditures

paid

to third parties for rent,

wages, supplies, tools, test inventory, and utilities made by the taxpayer for establishing and operating recycling or

composting technology in Utah

, up to a maximum credit of $2,000

.

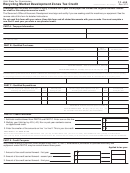

PART A - TAXPAYER INFORMATION

Enter name and address information of taxpayer. PART A must be signed by the Department of Community and Economic

Development authorizing this credit.

PART B - QUALIFIED PURCHASES

List any machinery or equipment purchased and used directly in commercial composting or in manufacturing facilities or

plant units that manufacture, process, compound or produce recycled items for sale or reduce or reuse post consumer

waste material, and enter the purchase price. Add all purchases and multiply the total purchases by 5% (.05). This is the

credit for machinery and equipment.

PART C - QUALIFIED EXPENDITURES

List expenditures for rent, wages, supplies, tools, test inventory, and utilities and the amount of the expenditure in the

appropriate column. Total all expenditures listed in PART C and multiply the total by 20% (.20). If the amount is greater

than $2,000, only enter $2,000.

PART D - CREDIT CALCULATION

Add together the "

Total credit allowed

" from PARTS B and C. Multiply the amount of your Utah income tax by 40% (.40).

Non or part-year residents must use the apportioned Utah tax. Your Recycling Market Development Zone Tax Credit is the

smaller of line 1 or line 2.

PART E - CREDIT CARRYOVER

Taxpayers may carry forward for three years any of the unused total credit allowed in PART D, line 3, that is attributable to

purchases of qualified machinery and equipment under PART B. Indicate the amounts you are carrying forward, along

with the appropriate years, on lines 1 through 3 of PART E.

Carryforward recycling market development zone credits shall be applied against Utah individual income tax, corporate

franchise or income tax or fiduciary tax due before the application of any recycling market development zone tax credits

earned in the current year and on a first-earned, first-used basis.

Do not send this form with your return. Keep this form and all related documents with your records. You must

complete a new form each year you claim a carryforward credit.

To approve this credit, contact the Governor's Office of Economic Development, 324 S State St, Suite 500, Salt Lake City,

Utah 84111, telephone number 801-538-8804. For more information, go to

If you need additional information, please contact the Utah State Tax Commission at 801-297-2200 or toll free

1-800-662-4335, if outside the Salt Lake area. The address is 210 N 1950 W, Salt Lake City, Utah 84134.

1

1 2

2