Form E-1 - Vermont Estate Tax Return Page 4

ADVERTISEMENT

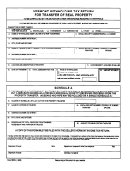

COMPUTATION SCHEDULES

SCHEDULE A. Vermont Estate Tax Calculation - For use by all filers.

To complete the worksheet below, you will need to complete a pro forma Federal Form 706 leaving Line 3b blank. If the estate

is not subject to federal tax, the complete 706, including exhibits and appraisals must be submitted with the Vermont return. If

the estate is subject to federal tax, the exhibits and appraisals do not need to be submitted with the Vermont return.

1. Federal tentative taxable estate from Federal Form 706, Page 1, Line 3a . . . . . . . . . . . . . . . . . . . . 1. _______________________

60,000.00

2. Adjustment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. _______________________

3. Adjusted taxable estate. Subtract Line 2 from Line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. _______________________

4. Use the amount on Line 3 above to compute the estate tax liability

using the Vermont Estate Tax Table. Enter the tax amount here. . . . . . . . . . . . . . . . . . . . . . . . . . . 4. _______________________

5. Enter amount from pro forma Federal Form 706, Page 1, Line 12 . . . . . . . . . . . . . . . . . . . . . . . . . 5. _______________________

6. Vermont estate tax. Enter the amount from Line 4 or Line 5, whichever is smaller. . . . . . . . . . . . 6. _______________________

Vermont Estate Tax Table - Computation of Estate Tax Liability

(1)

(2)

(3)

(4)

(1)

(2)

(3)

(4)

Adjusted taxable

Adjusted taxable

Tax on amount in

Rate of tax on

Adjusted taxable

Adjusted taxable

Tax on amount in

Rate of tax on

estate equal to or

estate less than -

column (1)

excess over

estate equal to or

estate less than -

column (1)

excess over

more than -

amount in

more than -

amount in

column (1)

column (1)

0

$40,000

0

None

2,540,000

3,040,000

146,800

8.8%

$40,000

90,000

0

0.8%

3,040,000

3,540,000

190,800

9.6%

90,000

140,000

$400

1.6%

3,540,000

4,040,000

238,800

10.4%

140,000

240,000

1,200

2.4%

4,040,000

5,040,000

290,800

11.2%

240,000

440,000

3,600

3.2%

5,040,000

6,040,000

402,800

12.0%

440,000

640,000

10,000

4.0%

6,040,000

7,040,000

522,800

12.8%

640,000

840,000

18,000

4.8%

7,040,000

8,040,000

650,800

13.6%

840,000

1,040,000

27,600

5.6%

8,040,000

9,040,000

786,800

14.4%

1,040,000

1,540,000

38,800

6.4%

9,040,000

10,040,000

930,800

15.2%

1,540,000

2,040,000

70,800

7.2%

10,040,000

- - -

1,082,800

16.0%

2,040,000

2,540,000

106,800

8.0%

SCHEDULE B. Vermont Resident Decedents with real and tangible personal property located outside Vermont. (Attach a copy of

the complete 706 unless a federal tax is due. In those cases, attach the 706 excluding exhibits and appraisals.)

1. Vermont estate tax from Schedule A, Line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1.

$

2. Tax liability actually paid for death taxes to a state other than Vermont

(Copies of nonresident returns must be attached.) . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

$

3. Federal Total Gross Estate from Federal Form 706, Page 1, Line 1 . . . . . . . . . . . . . 3.

$

4. Non-Vermont Gross Estate* (see instructions for definition) . . . . . . . . . . . . . . . . . . 4.

$

5. Ratio of non-Vermont Gross Estate to Federal Estate (Line 4 divided by Line 3) . . 5.

6. Adjusted Vermont estate tax (Multiply Line 1 by Line 5) . . . . . . . . . . . . . . . . . . . . . 6.

$

7. Enter the lesser of Line 2 or 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7.

$

8. Tax Due (Line 1 less Line 7). Enter here and on front of return, Section B . . . . . . . . . . . . . . . . . . . . . . . .8.

$

SCHEDULE C. Nonresident Decedents with real and tangible personal property located in Vermont. (Attach a copy of the complete

706 unless a federal tax is due. In those cases, attach the 706 excluding exhibits and appraisals.)

9. Vermont estate tax from Schedule A, Line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.

$

10. Federal Total Gross from Federal Form 706, Page 1, Line 1 . . . . . . . . . . . . . . . . . 10.

$

11. Vermont Gross Estate** (see instructions for definition) . . . . . . . . . . . . . . . . . . . . 11.

$

12. Ratio of Vermont Gross Estate to Federal Estate (Line 11 divided by Line 10) . . . 12.

13. Adjusted Vermont estate tax (Multiply Line 9 by Line 12)

Tax Due. Enter here and on front of return, Section C. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .13.

$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4