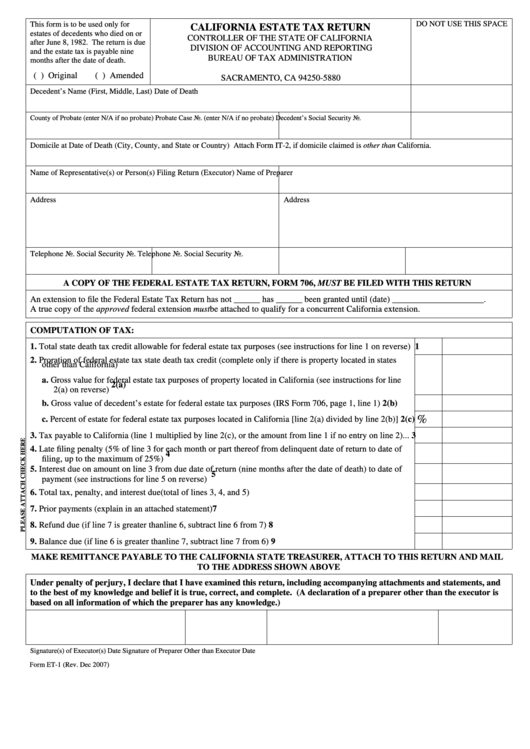

DO NOT USE THIS SPACE

This form is to be used only for

CALIFORNIA ESTATE TAX RETURN

estates of decedents who died on or

CONTROLLER OF THE STATE OF CALIFORNIA

after June 8, 1982. The return is due

DIVISION OF ACCOUNTING AND REPORTING

and the estate tax is payable nine

BUREAU OF TAX ADMINISTRATION

months after the date of death.

P.O. BOX 942850

( ) Original

( ) Amended

SACRAMENTO, CA 94250-5880

Decedent’s Name (First, Middle, Last)

Date of Death

County of Probate (enter N/A if no probate)

Probate Case No. (enter N/A if no probate)

Decedent’s Social Security No

.

Domicile at Date of Death (City, County, and State or Country) Attach Form IT-2, if domicile claimed is other than California.

Name of Representative(s) or Person(s) Filing Return (Executor)

Name of Preparer

Address

Address

Telephone No.

Social Security No.

Telephone No.

Social Security No.

A COPY OF THE FEDERAL ESTATE TAX RETURN, FORM 706, MUST BE FILED WITH THIS RETURN

An extension to file the Federal Estate Tax Return has not ______ has ______ been granted until (date) _____________________.

A true copy of the approved federal extension must be attached to qualify for a concurrent California extension.

COMPUTATION OF TAX:

1. Total state death tax credit allowable for federal estate tax purposes (see instructions for line 1 on reverse)

1

2. Proration of federal estate tax state death tax credit (complete only if there is property located in states

other than California)......................................................................................................................................

a. Gross value for federal estate tax purposes of property located in California (see instructions for line

2(a)

2(a) on reverse)..........................................................................................................................................

b. Gross value of decedent’s estate for federal estate tax purposes (IRS Form 706, page 1, line 1) .............

2(b)

%

c. Percent of estate for federal estate tax purposes located in California [line 2(a) divided by line 2(b)] .....

2(c)

3. Tax payable to California (line 1 multiplied by line 2(c), or the amount from line 1 if no entry on line 2) ...

3

4. Late filing penalty (5% of line 3 for each month or part thereof from delinquent date of return to date of

4

filing, up to the maximum of 25%).................................................................................................................

5. Interest due on amount on line 3 from due date of return (nine months after the date of death) to date of

5

payment (see instructions for line 5 on reverse) .............................................................................................

6. Total tax, penalty, and interest due (total of lines 3, 4, and 5) ........................................................................

6

7. Prior payments (explain in an attached statement)..........................................................................................

7

8. Refund due (if line 7 is greater than line 6, subtract line 6 from 7) ................................................................

8

9. Balance due (if line 6 is greater than line 7, subtract line 7 from 6) ...............................................................

9

MAKE REMITTANCE PAYABLE TO THE CALIFORNIA STATE TREASURER, ATTACH TO THIS RETURN AND MAIL

TO THE ADDRESS SHOWN ABOVE

Under penalty of perjury, I declare that I have examined this return, including accompanying attachments and statements, and

to the best of my knowledge and belief it is true, correct, and complete. (A declaration of a preparer other than the executor is

based on all information of which the preparer has any knowledge.)

Signature(s) of Executor(s)

Date

Signature of Preparer Other than Executor

Date

Form ET-1 (Rev. Dec 2007)

1

1