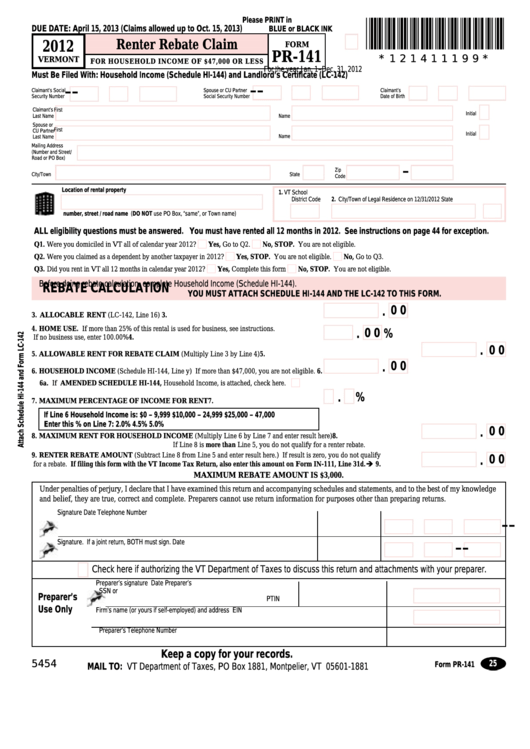

Form Pr-141 - Vermont Renter Rebate Claim For Household Income Of 47,000 Or Less - 2012

ADVERTISEMENT

Please PRINT in

*121411199*

DUE DATE: April 15, 2013 (Claims allowed up to Oct. 15, 2013)

BLUE or BLACK INK

Renter Rebate Claim

2012

FORM

* 1 2 1 4 1 1 1 9 9 *

PR-141

VERMONT

FOR HOUSEHOLD INCOME OF $47,000 OR LESS

For the year Jan. 1–Dec. 31, 2012

Must Be Filed With: Household Income (Schedule HI -144) and Landlord’s Certificate (LC-142)

-

-

-

-

Claimant’s Social

Spouse or CU Partner

Claimant’s

Security Number

Social Security Number

Date of Birth

Claimant’s

First

Initial

Last Name

Name

Spouse or

First

CU Partner

Initial

Name

Last Name

Mailing Address

(Number and Street/

Road or PO Box)

-

Zip

City/Town

State

Code

Location of rental property

1.

VT School

2. City/Town of Legal Residence on 12/31/2012

State

District Code

number, street / road name (DO NOT use PO Box, “same”, or Town name)

ALL eligibility questions must be answered. You must have rented all 12 months in 2012. See instructions on page 44 for exception.

c

c

Q1. Were you domiciled in VT all of calendar year 2012? . . . . . . . . . . . . . . . . . . .

Yes, Go to Q2 .

No, STOP. You are not eligible .

c

c

Q2. Were you claimed as a dependent by another taxpayer in 2012? . . . . . . . . . . .

Yes, STOP. You are not eligible .

No, Go to Q3 .

c

c

Q3. Did you rent in VT all 12 months in calendar year 2012? . . . . . . . . . . . . . . . .

Yes, Complete this form

No, STOP. You are not eligible .

Before doing rebate calculation, complete Household Income (Schedule HI-144).

REBATE CALCULATION

YOU MUST ATTACH SCHEDULE HI-144 AND THE LC-142 TO THIS FORM.

.

0 0

3. ALLOCABLE RENT (LC-142, Line 16) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

0 0 %

.

4. HOME USE. If more than 25% of this rental is used for business, see instructions .

If no business use, enter 100 .00% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

.

0 0

5. ALLOWABLE RENT FOR REBATE CLAIM (Multiply Line 3 by Line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

.

0 0

6. HOUSEHOLD INCOME (Schedule HI-144, Line y) If more than $47,000, you are not eligible . 6.

c

6a. If AMENDED SCHEDULE HI-144, Household Income, is attached, check here .

%

.

7. MAXIMUM PERCENTAGE OF INCOME FOR RENT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

If Line 6 Household Income is:

$0 – 9,999

$10,000 – 24,999

$25,000 – 47,000

Enter this % on Line 7:

2.0%

4.5%

5.0%

.

0 0

8. MAXIMUM RENT FOR HOUSEHOLD INCOME (Multiply Line 6 by Line 7 and enter result here) . . . . . . . . . . . . . . . . . . . . . . . 8.

If Line 8 is more than Line 5, you do not qualify for a renter rebate .

9. RENTER REBATE AMOUNT (Subtract Line 8 from Line 5 and enter result here .) If result is zero, you do not qualify

.

0 0

for a rebate . If filing this form with the VT Income Tax Return, also enter this amount on Form IN-111, Line 31d. . . . . . . . . . è 9.

MAXIMUM REBATE AMOUNT IS $3,000.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge

and belief, they are true, correct and complete . Preparers cannot use return information for purposes other than preparing returns .

Signature

Date

Telephone Number

-

-

Signature. If a joint return, BOTH must sign.

Date

-

-

Check here if authorizing the VT Department of Taxes to discuss this return and attachments with your preparer.

Preparer’s signature

Date

Preparer’s

SSN or

Preparer’s

PTIN

Use Only

Firm’s name (or yours if self-employed) and address

EIN

Preparer’s Telephone Number

Keep a copy for your records.

25

Form PR-141

MAIL TO: VT Department of Taxes, PO Box 1881, Montpelier, VT 05601-1881

5454

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2