Instructions for 2012 Form 8

Who Must File

All corporations doing business in Wisconsin must file with the Wisconsin Department of Revenue a report of transfers of capital stock

made by individuals who were Wisconsin residents during the CALENDAR YEAR 2012. File Form 8 only for the Wisconsin residents

who disposed of their stock and not for the persons who acquired it. Failure to file Form 8 by March 15, 2013, or filing an incorrect

Form 8 due to willful neglect, may result in a penalty of $10 for each violation.

When to File

File Form 8 by March 15, 2013, for stock transfers during calendar year 2012.

Additional Forms or Assistance

If you need more forms, download them from the Department’s web site at , request forms online at

wi.gov, or call (608) 266-1961. For help in preparing Form 8, e-mail corp@revenue.wi.gov, call (608) 266-2772, or write to the Audit

Bureau, Wisconsin Department of Revenue, Mail Stop 5-144, PO Box 8906, Madison, WI 53708-8906.

Specific Instructions

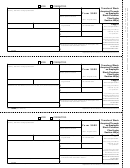

Enter the name and address of the reporting corporation, the name and address of the transferor, the number of shares transferred,

and the par value per share. Also enter the transferrer's social security number, if known.

Instructions for 2012 Form 8

Who Must File

All corporations doing business in Wisconsin must file with the Wisconsin Department of Revenue a report of transfers of capital stock

made by individuals who were Wisconsin residents during the CALENDAR YEAR 2012. File Form 8 only for the Wisconsin residents

who disposed of their stock and not for the persons who acquired it. Failure to file Form 8 by March 15, 2013, or filing an incorrect

Form 8 due to willful neglect, may result in a penalty of $10 for each violation.

When to File

File Form 8 by March 15, 2013, for stock transfers during calendar year 2012.

Additional Forms or Assistance

If you need more forms, download them from the Department’s web site at , request forms online at

wi.gov, or call (608) 266-1961. For help in preparing Form 8, e-mail corp@revenue.wi.gov, call (608) 266-2772, or write to the Audit

Bureau, Wisconsin Department of Revenue, Mail Stop 5-144, PO Box 8906, Madison, WI 53708-8906.

Specific Instructions

Enter the name and address of the reporting corporation, the name and address of the transferor, the number of shares transferred,

and the par value per share. Also enter the transferrer's social security number, if known.

Instructions for 2012 Form 8

Who Must File

All corporations doing business in Wisconsin must file with the Wisconsin Department of Revenue a report of transfers of capital stock

made by individuals who were Wisconsin residents during the CALENDAR YEAR 2012. File Form 8 only for the Wisconsin residents

who disposed of their stock and not for the persons who acquired it. Failure to file Form 8 by March 15, 2013, or filing an incorrect

Form 8 due to willful neglect, may result in a penalty of $10 for each violation.

When to File

File Form 8 by March 15, 2013, for stock transfers during calendar year 2012.

Additional Forms or Assistance

If you need more forms, download them from the Department’s web site at , request forms online at

wi.gov, or call (608) 266-1961. For help in preparing Form 8, e-mail corp@revenue.wi.gov, call (608) 266-2772, or write to the Audit

Bureau, Wisconsin Department of Revenue, Mail Stop 5-144, PO Box 8906, Madison, WI 53708-8906.

Specific Instructions

Enter the name and address of the reporting corporation, the name and address of the transferor, the number of shares transferred,

and the par value per share. Also enter the transferrer's social security number, if known.

1

1 2

2