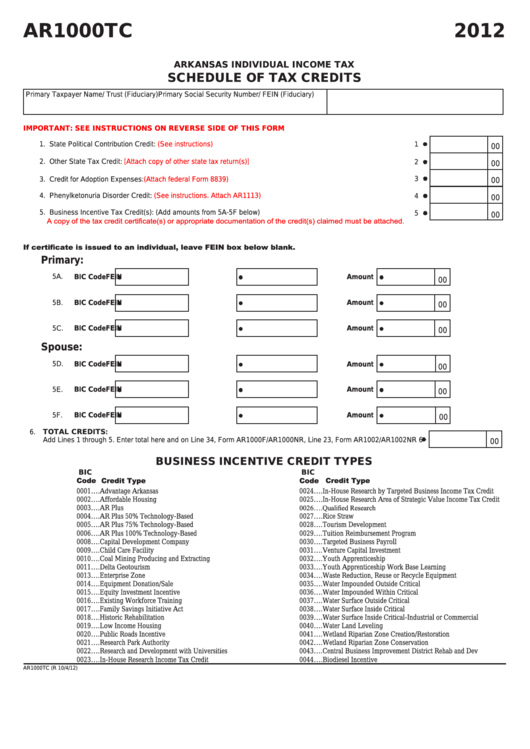

AR1000TC

2012

ARKANSAS INDIVIDUAL INCOME TAX

SCHEDULE OF TAX CREDITS

Primary Taxpayer Name/ Trust (Fiduciary)

Primary Social Security Number/ FEIN (Fiduciary)

IMPORTANT: SEE INSTRUCTIONS ON REVERSE SIDE OF THIS FORM

1. State Political Contribution Credit:

(See instructions) .......................................................................................................

1

00

2. Other State Tax Credit:

[Attach copy of other state tax return(s)] .....................................................................................

2

00

3

3. Credit for Adoption Expenses:

(Attach federal Form 8839) ..............................................................................................

00

4. Phenylketonuria Disorder Credit:

(See instructions. Attach AR1113) ...............................................................................

4

00

5. Business Incentive Tax Credit(s): (Add amounts from 5A-5F below) ...............................................................................

5

00

A copy of the tax credit certificate(s) or appropriate documentation of the credit(s) claimed must be attached.

If certificate is issued to an individual, leave FEIN box below blank.

Primary:

5A.

BIC Code

FEIN

Amount

00

5B.

BIC Code

FEIN

Amount

00

5C.

Amount

BIC Code

FEIN

00

Spouse:

5D.

BIC Code

FEIN

Amount

00

BIC Code

5E.

FEIN

Amount

00

BIC Code

Amount

5F.

FEIN

00

TOTAL CREDITS:

6.

Add Lines 1 through 5. Enter total here and on Line 34, Form AR1000F/AR1000NR, Line 23, Form AR1002/AR1002NR 6

00

BUSINESS INCENTIVE CREDIT TYPES

BIC

BIC

Code

Credit Type

Code

Credit Type

0001….Advantage Arkansas

0024….In-House Research by Targeted Business Income Tax Credit

0002….Affordable Housing

0025….In-House Research Area of Strategic Value Income Tax Credit

0026….Qualified Research

0003….AR Plus

0004….AR Plus 50% Technology-Based

0027….Rice Straw

0005….AR Plus 75% Technology-Based

0028….Tourism Development

0006….AR Plus 100% Technology-Based

0029….Tuition Reimbursement Program

0008….Capital Development Company

0030….Targeted Business Payroll

0009….Child Care Facility

0031….Venture Capital Investment

0010….Coal Mining Producing and Extracting

0032….Youth Apprenticeship

0011….Delta Geotourism

0033….Youth Apprenticeship Work Base Learning

0013….Enterprise Zone

0034….Waste Reduction, Reuse or Recycle Equipment

0014….Equipment Donation/Sale

0035….Water Impounded Outside Critical

0015….Equity Investment Incentive

0036….Water Impounded Within Critical

0016….Existing Workforce Training

0037….Water Surface Outside Critical

0017….Family Savings Initiative Act

0038….Water Surface Inside Critical

0018….Historic Rehabilitation

0039….Water Surface Inside Critical-Industrial or Commercial

0019….Low Income Housing

0040….Water Land Leveling

0020….Public Roads Incentive

0041….Wetland Riparian Zone Creation/Restoration

0021….Research Park Authority

0042….Wetland Riparian Zone Conservation

0022….Research and Development with Universities

0043….Central Business Improvement District Rehab and Dev

0023….In-House Research Income Tax Credit

0044….Biodiesel Incentive

AR1000TC (R 10/4/12)

1

1 2

2