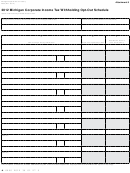

2012 Form 4R

Page

2 of 2

Part III Subtotal

.

00

11 Enter amount from line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

.

00

12 Net capital gains included on line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

.

00

13 Subtract line 12 from line 11 (net capital gains will be recomputed on line 23) . . . . . . . 13

14 Sum of charitable contributions deduction, net section 1231 losses, and losses from

.

00

involuntary conversions included on line 11 (enter as a positive amount) . . . . . . . . . . . 14

.

00

15 Add lines 13 and 14 (the deduction on line 14 will be recomputed on line 24). . . . . . . . 15

Part IV Corporations in Federal Consolidated Return Which Are Not Combined

Group Members

For amounts entered on lines 16, 18, and 19, use a separate schedule to identify each

corporation, its FEIN, and amount included on that line. Enter the federal separate taxable

incomes before net capital gains and charitable contribution deductions.

Federal separate taxable incomes of corporations in the consolidated return

16

.

00

that are not engaged in the combined group's unitary business . . . . . . . . . . . . . . . .

16

Were any corporations included on line 16 included in a combined return for

17

the unitary business in another state for the taxable year where the inclusion

was not by election? (If yes, explain on an attached statement.). . . . . . . . . . . . . . . .

Yes

17

No

Federal separate taxable incomes of corporations in the consolidated

18

return that are not combined group members due to the water's edge rules

.

00

(do not include corporations already included on line 16) . . . . . . . . . . . . . . . . . . . . .

18

Federal separate taxable incomes of other corporations in the consolidated

19

return that are not combined group members (explain on an attached statement) . .

.

00

19

.

00

Add lines 16, 18, and 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

20

Subtract line 20 from line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

00

21

21

Part V Adjustments Based on Limitations in Federal Law

See instructions for how to compute lines 22 through 24 and supporting detail required.

Adjustment to defer or recognize intercompany income, expense, gain, or loss

22

.

00

between combined group members. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

23

Recomputed net capital gain, applying capital loss limitation at combined group

.

00

level. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

Sum of recomputed charitable contributions deduction, net section 1231 losses,

24

and losses from involuntary conversions, applying limitations at combined group

.

00

level (enter as a negative amount) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

00

.

Other adjustments based on federal law (explain on an attached statement) . . . . . .

25

25

.

00

Add lines 21 through 25. Enter this amount on Form 4, line 1 . . . . . . . . . . . . . . . . . .

26

26

1

1 2

2