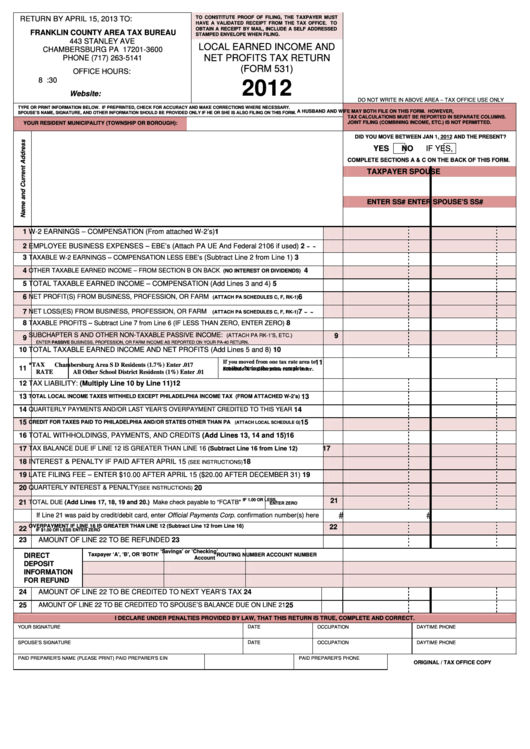

Form 531 - Local Earned Income And Net Profits Tax Return - 2012

ADVERTISEMENT

RETURN BY APRIL 15, 2013 TO:

TO CONSTITUTE PROOF OF FILING, THE TAXPAYER MUST

HAVE A VALIDATED RECEIPT FROM THE TAX OFFICE. TO

OBTAIN A RECEIPT BY MAIL, INCLUDE A SELF ADDRESSED

FRANKLIN COUNTY AREA TAX BUREAU

STAMPED ENVELOPE WHEN FILING.

443 STANLEY AVE

LOCAL EARNED INCOME AND

CHAMBERSBURG PA 17201-3600

NET PROFITS TAX RETURN

PHONE (717) 263-5141

(FORM 531)

OFFICE HOURS:

8 A.M. TO 4:30 P.M. MON. THRU FRI.

2012

Website:

DO NOT WRITE IN ABOVE AREA – TAX OFFICE USE ONLY

TYPE OR PRINT INFORMATION BELOW. IF PREPRINTED, CHECK FOR ACCURACY AND MAKE CORRECTIONS WHERE NECESSARY.

A HUSBAND AND WIFE MAY BOTH FILE ON THIS FORM. HOWEVER,

SPOUSE’S NAME, SIGNATURE, AND OTHER INFORMATION SHOULD BE PROVIDED ONLY IF HE OR SHE IS ALSO FILING ON THIS FORM.

TAX CALCULATIONS MUST BE REPORTED IN SEPARATE COLUMNS.

JOINT FILING (COMBINING INCOME, ETC.) IS NOT PERMITTED.

YOUR RESIDENT MUNICIPALITY (TOWNSHIP OR BOROUGH):

DID YOU MOVE BETWEEN JAN 1, 2012 AND THE PRESENT?

YES

NO

IF YES,

COMPLETE SECTIONS A & C ON THE BACK OF THIS FORM.

TAXPAYER

SPOUSE

ENTER SS#

ENTER SPOUSE’S SS#

1

W-2 EARNINGS – COMPENSATION (From attached W-2’s)

1

-

-

2

EMPLOYEE BUSINESS EXPENSES – EBE’s (Attach PA UE And Federal 2106 if used)

2

3

TAXABLE W-2 EARNINGS – COMPENSATION LESS EBE’s

(Subtract Line 2 from Line 1)

3

4

4

OTHER TAXABLE EARNED INCOME – FROM SECTION B ON BACK

(NO INTEREST OR DIVIDENDS)

TOTAL TAXABLE EARNED INCOME – COMPENSATION (Add Lines 3 and 4)

5

5

6

NET PROFIT(S) FROM BUSINESS, PROFESSION, OR FARM

6

(ATTACH PA SCHEDULES C, F, RK-1)

-

-

7

7

NET LOSS(ES) FROM BUSINESS, PROFESSION, OR FARM

(ATTACH PA SCHEDULES C, F, RK-1)

8

TAXABLE PROFITS – Subtract Line 7 from Line 6 (IF LESS THAN ZERO, ENTER ZERO)

8

SUBCHAPTER S AND OTHER NON-TAXABLE PASSIVE INCOME:

(ATTACH PA RK-1’S, ETC.)

9

9

.

ENTER PASSIVE BUSINESS, PROFESSION, OR FARM INCOME AS REPORTED ON YOUR PA-40 RETURN

10

TOTAL TAXABLE EARNED INCOME AND NET PROFITS (Add Lines 5 and 8)

10

If you moved from one tax rate area to

*TAX

Chambersburg Area S D Residents (1.7%) Enter .017

11

11

another during the year, complete a

RATE

All Other School District Residents (1%) Enter .01

Schedule X to determine rate to enter.

12

TAX LIABILITY: (Multiply Line 10 by Line 11)

12

13

13

TOTAL LOCAL INCOME TAXES WITHHELD EXCEPT PHILADELPHIA INCOME TAX (FROM ATTACHED W-2’s)

14

QUARTERLY PAYMENTS AND/OR LAST YEAR’S OVERPAYMENT CREDITED TO THIS YEAR

14

15

15

CREDIT FOR TAXES PAID TO PHILADELPHIA AND/OR STATES OTHER THAN PA

(ATTACH LOCAL SCHEDULE G)

16

TOTAL WITHHOLDINGS, PAYMENTS, AND CREDITS (Add Lines 13, 14 and 15)

16

17

TAX BALANCE DUE IF LINE 12 IS GREATER THAN LINE 16

17

(Subtract Line 16 from Line 12)

18

INTEREST & PENALTY IF PAID AFTER APRIL 15

18

(SEE INSTRUCTIONS)

19

LATE FILING FEE – ENTER $10.00 AFTER APRIL 15 ($20.00 AFTER DECEMBER 31)

19

20

QUARTERLY INTEREST & PENALTY

20

(SEE INSTRUCTIONS)

IF 1.00 OR LESS,

21

TOTAL DUE (Add Lines 17, 18, 19 and 20.) Make check payable to “FCATB"

21

ENTER ZERO

#

#

If Line 21 was paid by credit/debit card, enter Official Payments Corp. confirmation number(s) here

OVERPAYMENT IF LINE 16 IS GREATER THAN LINE 12 (Subtract Line 12 from Line 16)

22

22

IF $1.00 OR LESS ENTER ZERO

23

AMOUNT OF LINE 22 TO BE REFUNDED

23

‘Savings’ or ‘Checking’

Taxpayer ‘A’, ‘B’, OR ‘BOTH’

ROUTING NUMBER

ACCOUNT NUMBER

DIRECT

Account

DEPOSIT

INFORMATION

FOR REFUND

AMOUNT OF LINE 22 TO BE CREDITED TO NEXT YEAR’S TAX

24

24

25

AMOUNT OF LINE 22 TO BE CREDITED TO SPOUSE’S BALANCE DUE ON LINE 21

25

I DECLARE UNDER PENALTIES PROVIDED BY LAW, THAT THIS RETURN IS TRUE, COMPLETE AND CORRECT.

YOUR SIGNATURE

DATE

OCCUPATION

DAYTIME PHONE

SPOUSE’S SIGNATURE

DATE

OCCUPATION

DAYTIME PHONE

PAID PREPARER’S NAME (PLEASE PRINT)

PAID PREPARER’S EIN

PAID PREPARER’S PHONE

ORIGINAL / TAX OFFICE COPY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2