Form C-3 Uge - State Of Connecticut Domicile Declaration - Connecticut Department Of Revenue

ADVERTISEMENT

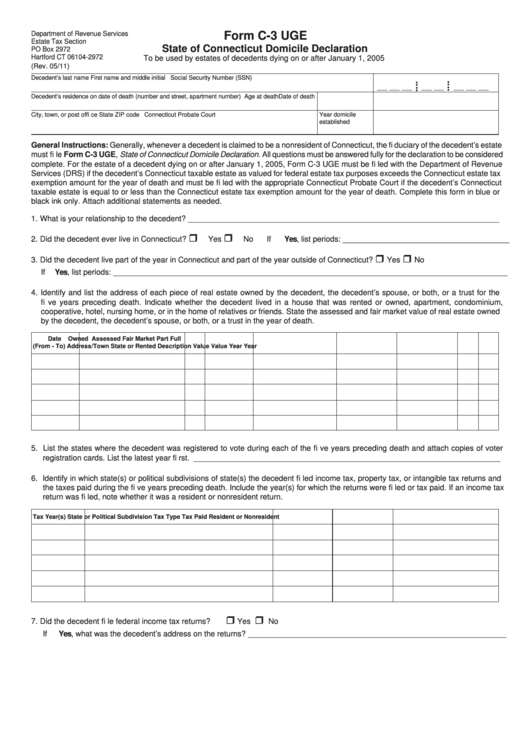

Department of Revenue Services

Form C-3 UGE

Estate Tax Section

State of Connecticut Domicile Declaration

PO Box 2972

Hartford CT 06104-2972

To be used by estates of decedents dying on or after January 1, 2005

(Rev. 05/11)

Decedent’s last name

First name and middle initial

Social Security Number (SSN)

• •

• •

__ __ __

__ __

__ __ __

• •

• •

Decedent’s residence on date of death (number and street, apartment number)

Age at death

Date of death

Year domicile

City, town, or post offi ce

State

ZIP code

Connecticut Probate Court

established

General Instructions: Generally, whenever a decedent is claimed to be a nonresident of Connecticut, the fi duciary of the decedent’s estate

must fi le Form C-3 UGE, State of Connecticut Domicile Declaration. All questions must be answered fully for the declaration to be considered

complete. For the estate of a decedent dying on or after January 1, 2005, Form C-3 UGE must be fi led with the Department of Revenue

Services (DRS) if the decedent’s Connecticut taxable estate as valued for federal estate tax purposes exceeds the Connecticut estate tax

exemption amount for the year of death and must be fi led with the appropriate Connecticut Probate Court if the decedent’s Connecticut

taxable estate is equal to or less than the Connecticut estate tax exemption amount for the year of death. Complete this form in blue or

black ink only. Attach additional statements as needed.

1. What is your relationship to the decedent? _______________________________________________________________________

2. Did the decedent ever live in Connecticut?

Yes

No

If Yes, list periods: ______________________________________

3. Did the decedent live part of the year in Connecticut and part of the year outside of Connecticut?

Yes

No

If Yes, list periods: __________________________________________________________________________________________

4. Identify and list the address of each piece of real estate owned by the decedent, the decedent’s spouse, or both, or a trust for the

fi ve years preceding death. Indicate whether the decedent lived in a house that was rented or owned, apartment, condominium,

cooperative, hotel, nursing home, or in the home of relatives or friends. State the assessed and fair market value of real estate owned

by the decedent, the decedent’s spouse, or both, or a trust in the year of death.

Date

Owned

Assessed

Fair Market

Part

Full

(From - To)

Address/Town

State

or Rented

Description

Value

Value

Year

Year

5. List the states where the decedent was registered to vote during each of the fi ve years preceding death and attach copies of voter

registration cards. List the latest year fi rst. ______________________________________________________________________

6. Identify in which state(s) or political subdivisions of state(s) the decedent fi led income tax, property tax, or intangible tax returns and

the taxes paid during the fi ve years preceding death. Include the year(s) for which the returns were fi led or tax paid. If an income tax

return was fi led, note whether it was a resident or nonresident return.

Tax Year(s)

State or Political Subdivision

Tax Type

Tax Paid

Resident or Nonresident

7. Did the decedent fi le federal income tax returns?

Yes

No

If Yes, what was the decedent’s address on the returns? ___________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3