Form Dor-3097 - Missouri Taxpayer Bill Of Rights Page 4

ADVERTISEMENT

reasons as a basis for an OIC: doubt as to collectibility, doubt

penalty (for employers) and criminal prosecution of willful

as to liability, or to promote effective tax administration.

attempts to evade or defeat the income tax.)

Further information, including Form MO-656 Missouri Offer

Sales and Use Tax Collection

in Compromise Form, may be obtained at:

tax/pros/compromise.htm

Listed below are the civil collection procedures for sales and use

tax assessments. The Underpay Notice is the first notification of a

Income Tax or Franchise Tax Collection

deficiency. You have 60 days from the date of the second notice,

Listed below are the civil collection procedures for individual

called the Notice of Assessment, to request a reassessment or

income tax, corporate income or franchise tax and employer

appeal the assessment to the Administrative Hearing Commission.

withholding tax deficiencies. The Notice of Adjustment is the

If you do not appeal or request a reassessment within the 60 day

first notification of a deficiency. You have 60 days from the

period, the assessment becomes final. You may, however, pay the

date of the second notice, called the Notice of Deficiency, to

assessment at any stage of the collection process.

request a redetermination by the Department. If you do not

request a redetermination within the 60 day period, the assess-

(Some delinquencies may be referred to a professional collection

ment becomes final. You may arrange to pay the deficiency at

agency. Missouri statutes also provide for a 100 percent civil

any stage of the collection process.

penalty and criminal prosecution of willful attempts to evade

or defeat state sales or use tax.)

(Some delinquencies may be referred to a professional collec-

tion agency. Missouri statutes also provide for a 100 percent

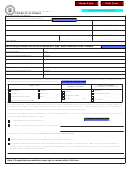

Underpay Notice

Notice of Adjustment

Notice of Assessment

Notice of Deficiency

Lien or Administrative

Default Judgment

10 Day Demand of Payment

Default Notice

Notice of Intent to Offset

Revocation of

Sales Tax License

Lien or Administrative

Default Judgment

Bond Forfeited

Deficiency Referred to Prosecuting

Deficiency Referred to Prosecuting

Attorney or Collection Agency

Attorney or Collection Agency

Taxpayer Services

Department of Revenue

Department of Revenue Tax Assistance Centers

Harry S Truman State Office Building, Room 330

Cape Girardeau

St. Joseph

301 W. High St., P.O. Box 854

3102 Blattner, Suite 102

State Office Building, Room 314

Jefferson City, MO 65105-0854

Cape Girardeau, MO 63703

525 Jules

Taxation Division:

(573) 290-5850

St. Joseph, MO 64501-1900

Individual Income Tax: (573) 751-3505

(816) 387-2230

Sales or Use Tax: (573) 751-2836

Jefferson City

St. Louis

Miscellaneous Business Taxes: (573) 751-2326

301 W. High St. Room 330

Corporate Income Tax: (573) 751-4541

3256 Laclede Station Road

Jefferson City, MO 65101

Corporate Franchise Tax: (573) 751-4541

Suite 101

(573) 751-7191

Motor Fuel: (573) 751-2611

St. Louis, MO 63143

Registration: (573) 751-5860

Joplin

(314) 877-0177

Employer Withholding: (573) 751-3505

1110 E. Seventh St., Suite 400

Springfield

Joplin, MO 64801-2076

Delinquent Taxes:

State Office Building, Room 313

(417) 629-3070

(573) 751-7200

149 Park Central Square

Kansas City

Ombudsman:

Springfield, MO 65806-3146

State Office Building

Department of Revenue

(417) 895-6474

615 East 13th St., Room 127

Office of the Ombudsman

Kansas City, MO 64106-2842

P.O. Box 1646

(816) 889-2944

Jefferson City, MO 65105-1646

(573) 526-3872

Individuals with speech or hearing impairments may reach a voice user through the

Field Compliance:

(573) 751-3736

Dual Party Relay Service. TDD (800) 735-2966.

4

DOR-3097 (04-2013)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4