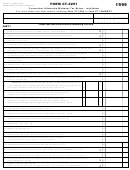

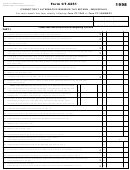

Form Ct-6251 - Connecticut Alternative Minimum Tax Return - Individuals - 2011 Page 4

ADVERTISEMENT

Line 4

Example: If the amount on Line 5 is $243,900, multiply

To compute the subtractions from federal alternative minimum

the amount in excess of $223,900 ($20,000) by 25% (.25).

taxable income, use the total amount entered on Form CT-1040,

The result is $5,000. Add the $5,000 to $243,900 and enter

Schedule 1, Line 50, or Form CT-1040NR/PY, Schedule 1,

$248,900 on Line 5.

Line 52, minus:

Line 10

Any modifi cation for refunds of state and local income taxes

entered on Form CT-1040, Schedule 1, Line 43, or Form

If you were under age 24 at the end of 2011, follow the instructions

CT-1040NR/PY, Schedule 1, Line 45;

to federal Form 6251, Line 29, to calculate the exemption amount.

Any modification for Tier 1 Railroad Retirement Benefits

Line 12

and Supplemental Annuities, as entered on Form CT-1040,

If Line 2 or Line 4 of Form CT-6251 is greater than zero and you

Schedule 1, Line 44, or Form CT-1040NR/PY, Schedule 1,

claimed a foreign earned income exclusion, housing exclusion, or

Line 46;

housing deduction on federal Form 2555 or federal Form 2555-EZ,

Any modification for the amount of any distributions you

you must complete the Connecticut Foreign Earned Income Tax

received from the Connecticut Higher Education Trust (CHET)

Worksheet below.

as a designated beneficiary to the extent included in your

Line 18

federal adjusted gross income, and to the extent included on

Form CT-1040, Schedule 1, Line 49, or Form CT-1040NR/PY,

Residents: Must enter 1.0000.

Schedule 1, Line 51;

Nonresidents and Part-Year Residents: To arrive at the

Any modification for the amount of interest earned on

apportionment factor, divide your total items of income, gain, loss,

contributions established for a designated benefi ciary under

or deduction from Connecticut sources associated with your

the Connecticut Homecare Option Program for the Elderly

adjusted federal alternative minimum taxable income by your total

to the extent the interest is includable in the federal adjusted

adjusted federal alternative minimum taxable income from Form

gross income of the designated benefi ciary and to the extent

CT-6251, Line 5.

included on Form CT-1040 Schedule 1, Line 49, or Form

To determine the total items of income, gain, loss, or deduction

CT-1040NR/PY, Schedule 1, Line 51; and

from Connecticut sources, you must net out certain modifi cations

Any modifi cation for the amount of income received from the

that may have been included in the amount shown on Form

U.S. government as retirement pay for a retired member of the

CT-1040NR/PY, Line 6. Refer to the instructions for Lines 2 and 4.

Armed Forces of the United States or the National Guard to the

You must further adjust the amount from Form CT-1040NR/PY,

extent included on Form CT-1040, Schedule 1, Line 45, or Form

Line 6, for any items entered on federal Form 6251, Lines 8

CT-1040NR/PY, Schedule 1, Line 47.

through 11 and 13 through 27, connected with or derived from

Include on Line 4 the amount of federally tax-exempt interest or

Connecticut sources.

exempt-interest dividends under IRC §852(b)(5) from Connecticut

private activity bonds issued after August 7, 1986, and included on

Part II

federal Form 6251, Line 12. Enter the net amount on Line 4.

If you completed Part III of federal Form 6251, complete Part II and

Line 5

enter the amount from Form CT-6251, Line 42, on Part I, Line 12.

However, if Line 2 and Line 4 are zero, skip Part II of this form and

If your fi ling status is fi ling separately and Line 5 is more than

enter the amount from federal Form 6251, Line 31, on Line 12.

$223,900, you must include an additional amount on Line 5

calculated as follows. If Line 5 is $372,800 or more, include an

Lines 25, 26, 27, and 32

additional $37,225 on Line 5. Otherwise, include 25% of the excess

When entering an amount on Lines 25, 26, 27, and 32, you must

of the amount on Line 5 over $223,900.

include the Schedule 1 modifi cation for the gain or loss on the sale of

Connecticut state and local government bonds from Form CT-1040,

Line 36 or Line 47, or Form CT-1040NR/PY, Line 38 or Line 49.

Connecticut Foreign Earned Income Tax Worksheet

1.

Enter the amount from Form CT-6251, Line 11. ...............................................................................................1. _____________

2. Enter the amount from your (and your spouse’s if fi ling jointly)

federal Form 2555, Lines 45 and 50, or federal Form 2555-EZ, Line 18. ........................................................2. _____________

3. Add Line 1 and Line 2. .....................................................................................................................................3. _____________

4. Tax amount on Line 3.

•

If you completed Part III of federal Form 6251, you must complete Part II of Form CT-6251. Enter the amount from

Line 3 of this worksheet on Part II, Line 24, of Form CT-6251. Complete the rest of Part II of Form CT-6251 and

enter the amount from Line 42 here.

•

All others: If line 3 is $175,000 or less ($87,500 or less if fi ling separately), multiply Line 3 by 26% (.26).

Otherwise, multiply Line 3 by 28% (.28) and subtract $3,500 ($1,750, if fi ling separately) from the result. ................................. 4. _____________

5. Tax on amount on Line 2. If Line 2 is $175,000 or less ($87,500 or less if fi ling separately), multiply Line 2 by 26% (.26).

Otherwise, multiply Line 2 by 28% (.28) and subtract $3,500 ($1,750, if fi ling separately) from the result. ..................................... 5. _____________

6. Subtract Line 5 from Line 4. Enter here and on Form CT-6251, Line 12. If zero or less, enter “0.” ................................................ 6. _____________

Form CT-6251 Instructions (Rev. 01/12)

Page 4 of 6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6