Form PT-STM General Information

entity pays this amount, the paid tax passes through the

multi-tiered structure as a refundable credit that may be

What is the purpose of this statement?

claimed by the owners who file their Montana individual

income, corporation license or other income tax returns.

When the owner of a pass-through entity (first-tier) that

has Montana source income is itself a pass-through

If the first-tier pass-through entity does not

entity (second-tier), the first-tier pass-through entity

timely pay tax due will interest and penalties be

must either include the second-tier pass-through entity

assessed?

in a composite return or pay tax on its behalf unless the

first-tier establishes that its distributive share of Montana

Yes, if tax is not paid by the original filing deadline of the

source income is fully accounted for on Montana individual

first-tier pass-through entity’s tax return, then any unpaid

income, corporation license or other income tax returns.

tax will be assessed interest and penalties until paid in full.

To establish this, the first-tier pass-through entity must be

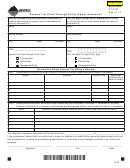

Form PT-STM Instructions

able to identify each entity (person, corporation, estate,

trust or composite filer) to which any part of its share of the

Use the following entity type codes to complete the form:

Montana source income will pass.

● C corporation doing business in MT (C)

Who prepares this statement?

● C corporation not doing business in MT (FC)

An authorized representative of the first-tier pass-through

● Disregarded entity (DE)

entity must complete this form. It is not valid unless it is

signed and dated by an officer or other individual who is

● Estate (E)

authorized to sign on behalf of the first-tier pass-through

● Individual (I)

entity. The first-tier pass-through entity includes the

completed statement with its Montana pass-through entity

● Partnership (PS)

information return.

● Publicly Traded Partnership (PTP)

How often does the first-tier pass-through entity

● S corporation (S)

have to complete this statement?

● Trust (T)

The first-tier pass-through entity has to complete this

statement each year it does not include the second-tier

If the entity is a nonprofit organization, use entity type code

C for nonprofit organizations formed in Montana and entity

pass-through entity in a composite return or pay tax on its

type code FC for nonprofit organizations formed outside of

behalf. If the first-tier pass-through entity cannot establish

on Form PT-STM that its distributive share of Montana

Montana.

source income is fully accounted for on Montana individual,

Page 1 – Second-Tier Pass-Through Entity Owner

corporation license or other income tax returns, it does not

Statement and Waiver Request

submit the form.

The Form PT-STM is required to be filed with the first-tier

What if the first-tier pass-through entity is part of

pass-through entity’s return.

a multi-tiered structure and it cannot identify all

● First-Tier Pass-Through Entity Information Enter

owners of all higher tiers?

the name, mailing address, entity type code and federal

The first-tier pass-through entity must file a composite

employer identification number (FEIN) for the first-tier

return or pay tax on behalf of the second-tier pass-through

pass-through entity.

entity unless each and every owner to whom any share

● Second-Tier Pass-Through Entity Information

of Montana source income is passed is identified and the

Enter the name, mailing address, entity type code and

first-tier pass-through entity verifies that every owner to

federal employer identification number (FEIN) for the

which the Montana source income is distributed will file a

second-tier pass-through entity.

Montana return.

Page 2 – Pass-Through Entity Owner Information

What happens if the statement is submitted to the

(third-tier, fourth-tier, etc.)

department and an entity to which the second-

tier pass-through entity’s share of income is

● Name and Address For each owner of the second-

ultimately passed does not file a Montana tax

tier and higher tier pass-through entities (if applicable),

return and pay the applicable tax?

provide the name, mailing address, entity type code

and federal employer identification number (FEIN) or

The department will assess the first-tier pass-through entity

social security number (SSN).

for its failure to pay tax for the second-tier pass-through

entity’s distributive share of Montana source income. The

● Residency Code If the owner is an individual, estate

amount that will be assessed is 6.9% multiplied by the

or trust that is a resident owner, mark the ‘R’ box.

distributive share of the second-tier pass-through entity’s

If the owner is an individual, estate or trust that is a

Montana source income. After the first-tier pass-through

nonresident owner, mark the ‘N’ box.

1

1 2

2 3

3 4

4