Form Ct-238 - Claim For Rehabilitation Of Historic Properties Credit - 2011

ADVERTISEMENT

Staple forms here

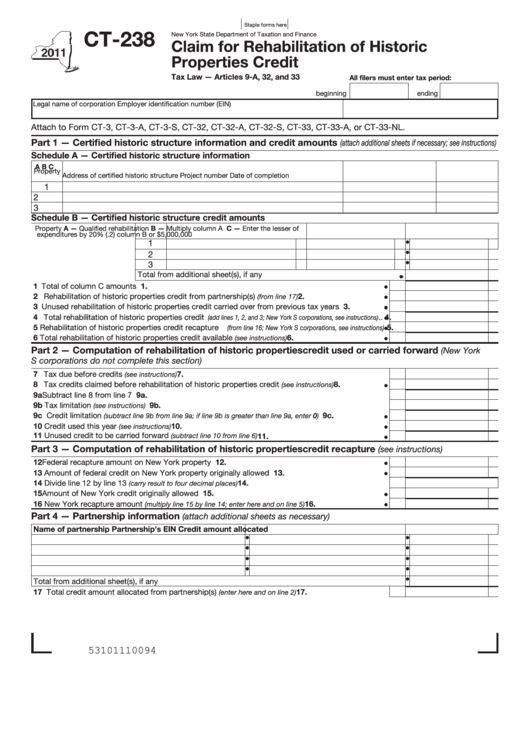

CT-238

New York State Department of Taxation and Finance

Claim for Rehabilitation of Historic

Properties Credit

Tax Law — Articles 9-A, 32, and 33

All filers must enter tax period:

beginning

ending

Legal name of corporation

Employer identification number (EIN)

Attach to Form CT-3, CT-3-A, CT-3-S, CT-32, CT-32-A, CT-32-S, CT-33, CT-33-A, or CT-33-NL.

Part 1 — Certified historic structure information and credit amounts

(attach additional sheets if necessary; see instructions)

Schedule A — Certified historic structure information

A

B

C

Property

Address of certified historic structure

Project number

Date of completion

1

2

3

Schedule B — Certified historic structure credit amounts

Property

A — Qualified rehabilitation

B — Multiply column A

C — Enter the lesser of

expenditures

by 20% (.2)

column B or $5,000,000

1

2

3

Total from additional sheet(s), if any ...............................................................

1 Total of column C amounts ...............................................................................................................

1.

2 Rehabilitation of historic properties credit from partnership(s)

2.

......................................

(from line 17)

3 Unused rehabilitation of historic properties credit carried over from previous tax years .................

3.

4 Total rehabilitation of historic properties credit

..

4.

(add lines 1, 2, and 3; New York S corporations, see instructions)

5 Rehabilitation of historic properties credit recapture

5.

(from line 16; New York S corporations, see instructions)

6 Total rehabilitation of historic properties credit available

.........................................

6.

(see instructions)

Part 2 — Computation of rehabilitation of historic properties credit used or carried forward

(New York

S corporations do not complete this section)

7 Tax due before credits

................................................................................................

7.

(see instructions)

8 Tax credits claimed before rehabilitation of historic properties credit

.....................

8.

(see instructions)

9a Subtract line 8 from line 7 ................................................................................................................... 9a.

9b Tax limitation

9b.

(see instructions) ............................................................................................................................

9c Credit limitation

9c.

(subtract line 9b from line 9a; if line 9b is greater than line 9a, enter 0) .................................

10 Credit used this year

................................................................................................

10.

(see instructions)

11 Unused credit to be carried forward

.........................................................

(subtract line 10 from line 6)

11.

Part 3 — Computation of rehabilitation of historic properties credit recapture

(see instructions)

12 Federal recapture amount on New York property .............................................................................

12.

13 Amount of federal credit on New York property originally allowed ...................................................

13.

14 Divide line 12 by line 13

................................................................... 14.

(carry result to four decimal places)

15 Amount of New York credit originally allowed ...................................................................................

15.

16 New York recapture amount

....................................

16.

(multiply line 15 by line 14; enter here and on line 5)

Part 4 — Partnership information

(attach additional sheets as necessary)

Name of partnership

Partnership’s EIN

Credit amount allocated

Total from additional sheet(s), if any .................................................................................................................

17 Total credit amount allocated from partnership(s)

........................................... 17.

(enter here and on line 2)

53101110094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2