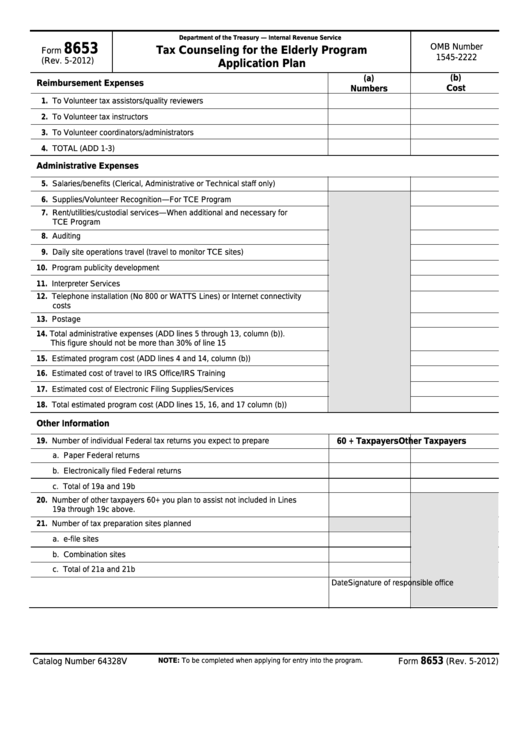

Department of the Treasury — Internal Revenue Service

8653

OMB Number

Tax Counseling for the Elderly Program

Form

1545-2222

(Rev. 5-2012)

Application Plan

(b)

(a)

Reimbursement Expenses

Cost

Numbers

1. To Volunteer tax assistors/quality reviewers

2. To Volunteer tax instructors

3. To Volunteer coordinators/administrators

4. TOTAL (ADD 1-3)

Administrative Expenses

5. Salaries/benefits (Clerical, Administrative or Technical staff only)

6. Supplies/Volunteer Recognition—For TCE Program

7. Rent/utilities/custodial services—When additional and necessary for

TCE Program

8. Auditing

9. Daily site operations travel (travel to monitor TCE sites)

10. Program publicity development

11. Interpreter Services

12. Telephone installation (No 800 or WATTS Lines) or Internet connectivity

costs

13. Postage

14. Total administrative expenses (ADD lines 5 through 13, column (b)).

This figure should not be more than 30% of line 15

15. Estimated program cost (ADD lines 4 and 14, column (b))

16. Estimated cost of travel to IRS Office/IRS Training

17. Estimated cost of Electronic Filing Supplies/Services

18. Total estimated program cost (ADD lines 15, 16, and 17 column (b))

Other Information

60 + Taxpayers

Other Taxpayers

19. Number of individual Federal tax returns you expect to prepare

a. Paper Federal returns

b. Electronically filed Federal returns

c. Total of 19a and 19b

20. Number of other taxpayers 60+ you plan to assist not included in Lines

19a through 19c above.

21. Number of tax preparation sites planned

a. e-file sites

b. Combination sites

c. Total of 21a and 21b

Signature of responsible office

Date

8653

Catalog Number 64328V

NOTE: To be completed when applying for entry into the program.

Form

(Rev. 5-2012)

1

1 2

2