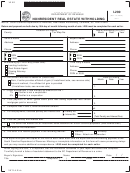

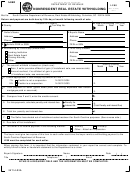

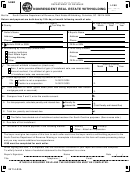

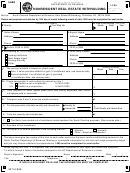

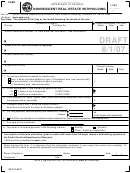

Form I-290 - Nonresident Real Estate Withholding Page 2

ADVERTISEMENT

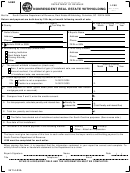

Instructions for Filing Form I-290

Anyone making payment to a nonresident seller for the purchase of real property or real and associated tangible

personal property must deduct and withhold on the sale. See SC Revenue Ruling #09-13 or any subsequent advisory

opinion regarding Nonresident Seller Withholding on our website

You must complete information concerning the location of property, date of withholding (date of payment), the seller's name, and

address, seller's SSN or FEIN, buyer's name and address, and buyer's SSN or FEIN, and the date of closing (date of sale of

property). Only in the case of installment sales will the date of withholding and the date of closing be a different date. Four copies must

be completed for each sale. The buyer must receive two copies, one for his or her records and one to send to the Department of

Revenue with his or her withholding payment. The seller must receive two copies, one to be sent in with his or her income tax return

reporting the sale and one for his or her records.

How do nonresidents claim credit for or request a refund for the amount withheld?

Nonresidents must file an income tax return during the appropriate filing season, reporting the capital gain from the sale and take credit

for the nonresident real estate withholding. See I-290X for refund prior to the end of the tax year of the sale. After year end, the

appropriate income tax return must be used.

Is there more than one seller?

If there is more than one seller (filing separate individual income tax returns), then separate I-290 forms must be filed. If the seller is a

partnership, subchapter S corporation, estate or trust, the buyer must issue one I-290 to the entity, reporting the total amount of

withholding (using the federal identification number). The entity will then allocate the tax withheld to each partner, shareholder or

beneficiary in proportion to their percent of ownership in the property sold.

What if the buyer or seller has no SSN?

In the case of a nonresident alien who cannot obtain a Social Security Number, contact the Internal Revenue Service to apply for and

obtain an Individual Taxpayer Identification Number by using federal Form W-7.

Line 1 - Enter the amount of gain or amount realized from the sale. The amount realized on the sale is the selling price less selling

expenses, as defined in Internal Revenue Code Section 1001(b). Amount realized is the figure used for computing gain or loss by

subtracting the basis of the property. Or, if the seller provides the buyer with an affidavit (I-295) stating the amount of gain he is

required to recognize on the sale, enter the amount of gain. I-295 can be obtained from our website:

If the transaction reported is an installment sale, enter on line 1 only the portion of gain (if the seller provided an affidavit of gain) or the

portion of the amount realized (if the seller does not provide an affidavit of gain ) the withholding payment is based upon. If the election

on line 7 is made, line 1 must indicate the entire gain if an affidavit of gain is provided by seller.

Line 2 - Check the appropriate box and multiply by the amount on line 1.

Line 3 - Selling expenses include real estate commissions, advertising fees, legal fees, deed recording fees and termite or heat/air

letter fees. The net proceeds payable to the seller is computed by reducing the sales price by mortgages or liens paid at closing on the

property being sold and selling expenses. Mortgages, liens, advances on credit lines, and other debt secured by the properties

assumed by the buyer in contemplation of the sale may not be deducted from the sales price. Loans or advances where the entire

proceeds are used to purchase or improve the property being sold are not loans in contemplation of the sale. Unless the buyer knows

otherwise, the buyer can presume that any liens, mortgages, or advances on credit lines made more than one year before the closing

are not in contemplation of the sale and may be deducted. If the lien, mortgage, or credit line advance is made less than one year prior

to the closing, the buyer cannot deduct the mortgage, lien, or credit line advance unless the buyer obtains an affidavit from the seller,

which states that the loan or advance was not made in contemplation of the sale.

Line 7 - The seller may give the buyer an affidavit (I-295) stating that, for South Carolina income tax purposes, he elects out of the

installment sales treatment and chooses to remit the amount of tax due on the entire gain by its due date.

Remitting the tax - I-290 must be completed for each seller. The withholding must be sent to SCDOR on or before the fifteenth day of

the month following the month in which the sale took place. Withholding on an installment sale, however, is not required where the total

amount required to be withheld for the entire year would be less than $350. Also, withholding on installment sales when the amount to

be withheld is less than $500 the buyer may wait to remit the amounts withheld to the Department of Revenue until the 15th day of the

month following the month when the amounts withheld equals $500 or more. However, if amounts withheld during a calendar year do

not equal $500 they must be remitted to the Department of Revenue by January 15th of the following year. See SC Revenue Ruling

#09-13 regarding installment sales.

Social Security Privacy Act

It is mandatory that you provide your social security number on this tax form. 42 U.S.C 405(c)(2)(C)(i) permits a state to use an individual's social

security number as means of identification in administration of any tax. SC Regulation 117-201 mandates that any person required to make a return to

the SC Department of Revenue shall provide identifying numbers, as prescribed, for securing proper identification. Your social security number is used

for identification purposes.

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the Department of Revenue is limited to the information

necessary for the Department to fulfill its statutory duties. In most instances, once this information is collected by the Department, it is protected by law

from public disclosure. In those situations where public disclosure is not prohibited, the Family Privacy Protection Act prevents such information from

being used by third parties for commercial solicitation purposes.

32712036

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2