Schedule G - Transfers During Decedent'S Life, Schedule H - Powers Of Appointment

ADVERTISEMENT

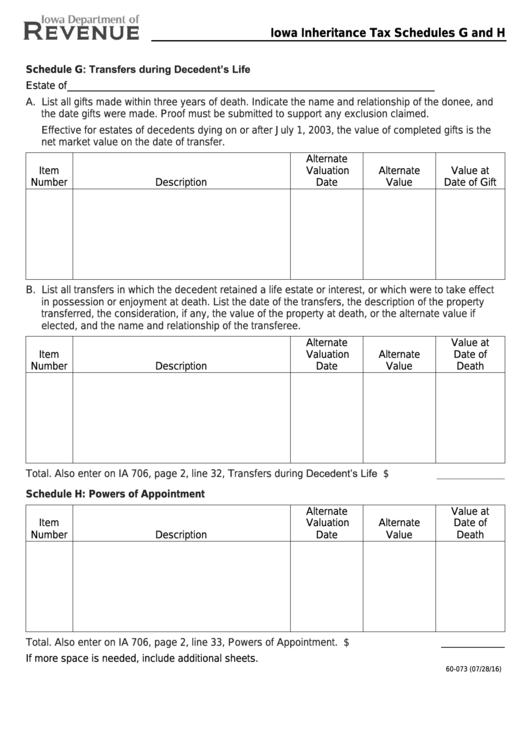

Iowa Inheritance Tax Schedules G and H

https://tax.iowa.gov

Schedule G: Transfers during Decedent’s Life

Estate of

A. List all gifts made within three years of death. Indicate the name and relationship of the donee, and

the date gifts were made. Proof must be submitted to support any exclusion claimed.

Effective for estates of decedents dying on or after July 1, 2003, the value of completed gifts is the

net market value on the date of transfer.

Alternate

Item

Valuation

Alternate

Value at

Number

Description

Date

Value

Date of Gift

B. List all transfers in which the decedent retained a life estate or interest, or which were to take effect

in possession or enjoyment at death. List the date of the transfers, the description of the property

transferred, the consideration, if any, the value of the property at death, or the alternate value if

elected, and the name and relationship of the transferee.

Alternate

Value at

Item

Valuation

Alternate

Date of

Number

Description

Date

Value

Death

Total. Also enter on IA 706, page 2, line 32, Transfers during Decedent’s Life ................. $

Schedule H: Powers of Appointment

Alternate

Value at

Item

Valuation

Alternate

Date of

Number

Description

Date

Value

Death

Total. Also enter on IA 706, page 2, line 33, Powers of Appointment. ................................ $

If more space is needed, include additional sheets.

60-073 (07/28/16)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1