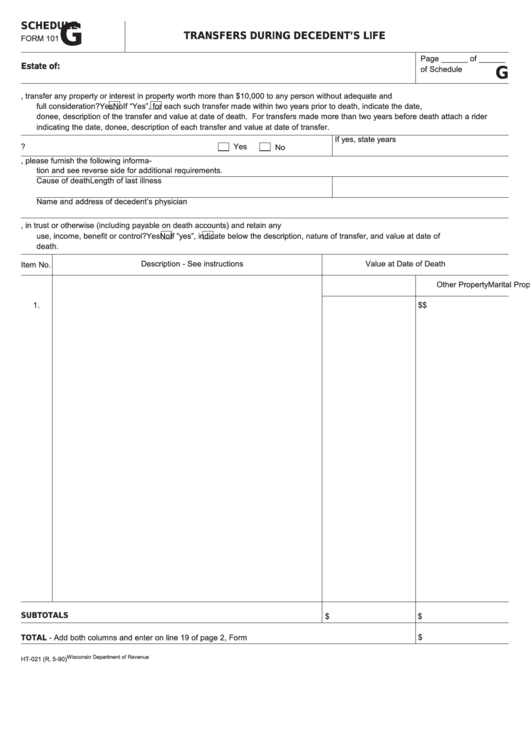

Schedule G Form 101 - Transfers During Decedent'S Life

ADVERTISEMENT

SCHEDULE

G

TRANSFERS DURING DECEDENT’S LIFE

FORM 101

Page ______ of ______

Estate of:

of Schedule

G

1.

Did the decedent in any year, transfer any property or interest in property worth more than $10,000 to any person without adequate and

full consideration?

Yes

No

If “Yes”, for each such transfer made within two years prior to death, indicate the date,

donee, description of the transfer and value at date of death. For transfers made more than two years before death attach a rider

indicating the date, donee, description of each transfer and value at date of transfer.

If yes, state years

2.

Have Wisconsin gift tax returns ever been filed?

Yes

No

3.

If it is contended that the transfers detailed below are not includable for inheritance tax purposes, please furnish the following informa-

tion and see reverse side for additional requirements.

Cause of death

Length of last illness

Name and address of decedent’s physician

4.

Did the decedent transfer any property or interest in property, in trust or otherwise (including payable on death accounts) and retain any

use, income, benefit or control?

Yes

No

If “yes”, indicate below the description, nature of transfer, and value at date of

death.

Description - See instructions

Value at Date of Death

Item No.

Marital Property

Other Property

1.

$

$

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

$

$

SUBTOTALS

$

TOTAL - Add both columns and enter on line 19 of page 2, Form 101

.

.

.

.

.

.

.

.

.

Wisconsin Department of Revenue

HT-021 (R. 5-90)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2